Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Where we stand: latest ECB minutes made clear ‘disinflationary forces were thus likely to dominate in the short term’, owing to tariff uncertainty, lower energy prices and a stronger euro over recent months.

Reality check: latest consumer expectations for inflation 1-year ahead actually rose to 3.1%, from 2.9% the previous month.

Implications: the ECB is fully aware of past mistakes, as highlighted by ECB member Schnabel – ‘Research from the early days of the pandemic showed that most consumers expected the pandemic to raise prices, contrary to the views held by professional forecasters at the time’.

The bottom line: the inflation outlook over the medium term is more ‘ambiguous’, paraphrasing ECB member Knot. Sometimes the best policy choice is to sit idle and wait and see.

Source: Bloomberg, as at April 2025.

Zoom out: investors must ask ‘What will Europe look like in 12-18 months’ time?’

By the numbers: the EU’s Spring forecasts point towards growth accelerating in 2026 to 1.5%, from 1.1% this year.

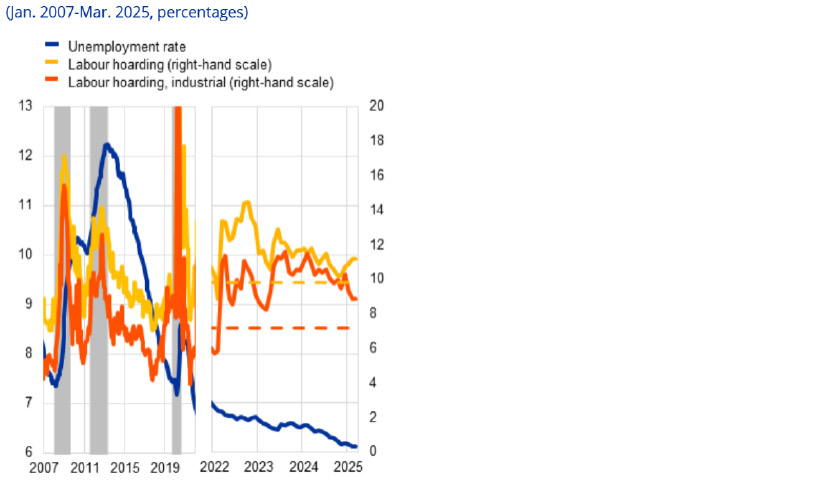

Context: infrastructure and defence spending are expected to ramp up (n.b. NATO is even pushing a 5%/GDP spending pledge) and existing facilities such as the Pandemic Recovery Facility are yet to be fully drawn. At the same time, with the unemployment rate at a historical low level, consumers will remain buoyant.

The bottom line: much of the risks to the European economy highlighted in the ECB’s latest Financial Stability report were more immediate. The picture could look very different in 2026.

Source: ECB FSR, as at May 2025.

Flashback: there have been many instances over the years where investors have been misled by polls (e.g. Brexit, French and Italian elections) which has led them to instances where conventional wisdoms have been wrong and costly.

Zoom out: the first round of the Romanian election sprung a surprise, and markets were quick to extrapolate a far-right victory heading into the second round.

Why it matters: an understanding of European political trends, the use of alternative data/news sources and experience in dealing with the intricacies of polling (turnout was a big factor) all help paint a fuller picture heading into close elections.

Where we stand: the centrist candidate, Dan, claimed victory despite betting (and financial) markets giving him a ~30% chance on the day after the first round.

Source: Polymarket.com

Where we stand: foreign participation is up, turnover is increasing, and the debt management office has been steadily building out the ISK yield curve e.g. ICEGBs due 2038 were issued a few months ago.

By the numbers: the key interest rate is 7.5%, with the latest headline inflation figure falling to 3.8%. Long-term bond yields are above 6.5% and provide plenty of juice for investors in a stable and low volatility FX regime.

The bottom line: Iceland is attracting investment as it (re)opens and builds out its capital markets, and we expect it to be one of the best performing economies in Europe for the rest of the decade.

Where we stand: Labour is now ~10pts behind Nigel Farage’s Reform Party in the latest polling and Starmer and co need to get the public back.

Why this matters: the policy changes the government is proposing all require extra cash via increased borrowing and/or further cuts to spending. Potential reversal of winter fuel payments; above inflation public sector pay awards; potential watering down the two child benefit cap; deal with the Chagos Islands; potential NATO 5% defence spending pledge.

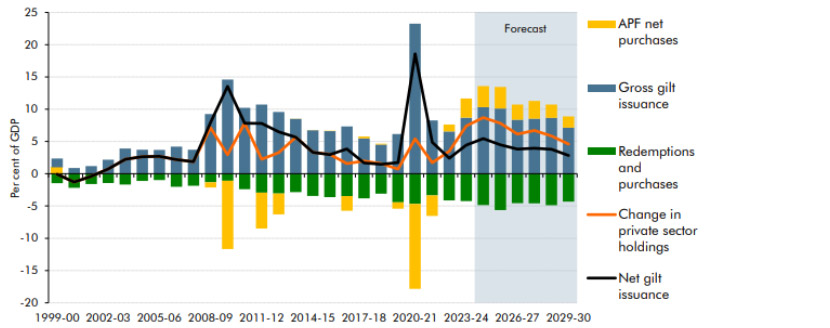

Bottom line: gross gilt issuance has splurged from £265bn in early 2024-25 to £309bn at the latest remit update. The government is acting in a fiscally irresponsible way at a time when the private sector needs to step up and absorb extra borrowing.

Source: OBR, as at March 2025.

All data sourced from Bloomberg, as at May 2025, unless otherwise stated.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2025 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.