Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

We participate in initiatives that work to increase transparency, protect investors, and foster fair and efficient capital markets.

RBC GAM is a signatory to the UN Principles for Responsible Investment (PRI)1. The PRI is a global network for investors committed to incorporating ESG considerations into their investment practices and ownership policies. We are committed to putting the PRI’s six Principles of Responsible Investment into practice and believe that they are aligned with our existing approach to responsible investment.

* In 2023, RBC GAM consolidated the activities of two regulated legal entities in the United Kingdom (UK), RBC GAM-UK and BlueBay Asset Management LLP (BlueBay), into RBC GAM-UK. BlueBay was a signatory to the PRI until the consolidation and completed its own submission to the PRI during the last reporting cycle.

PRI signatories commit to implement the six Principles of Responsible Investment and report on their activities and progress in implementing them.

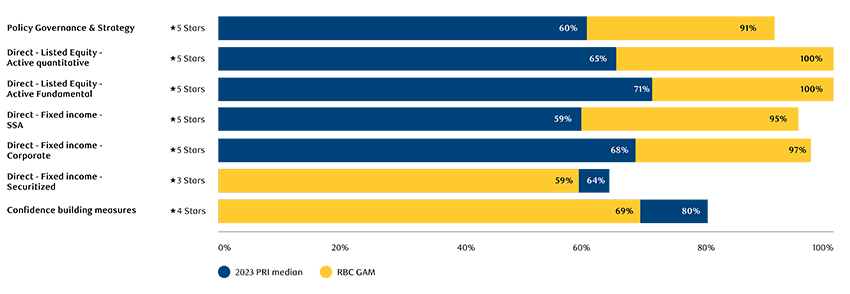

The PRI evaluates signatories' approaches to the Principles based on its assessment methodology. Please see below for the results of our most recent Assessment Report. The group to calculate module medians includes all PRI signatories who submitted and were eligible to report on the module:

As part of the paid annual membership services, the PRI evaluates signatories' approaches to the Principles based on its assessment methodology. Once the responses are assessed, all indicator scores are aggregated and modules are assigned a numerical score, converted from a points-based system ranging from 0 to 100. Our firm’s full transparency report as one of over 2,000 signatories can be found here: RBC GAM PRI Transparency Report. Our firm’s full private Assessment Report from the PRI is available upon request.

RBC GAM has committed to publishing an annual climate report, guided by the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The RBC GAM Climate Report is published in line with the regulatory requirements of the U.K. Financial Conduct Authority (FCA) Environmental, Social, and Governance Sourcebook (ESG Sourcebook).

Find contact names, phone numbers and email addresses for RBC BlueBay's regional sales teams and client directors.

1. In 2023, RBC GAM consolidated the activities of two regulated legal entities in the United Kingdom (UK), RBC GAM-UK and BlueBay Asset Management LLP (BlueBay), into RBC GAM-UK. Signatory status falls under the RBC Global Asset Management’s (RBC GAM) group membership as of April 2023 onwards and is not related to funds. Up until this period, both RBC GAM and its affiliate, BlueBay Asset Management LLP (BlueBay) were signatories (signatory year being 2015 for RBC GAM, and 2013 for BlueBay). Both entities separately filed annual transparency reports (where RBC GAM’s one included affiliates RBC Global Asset Management (UK) and BlueBay). With the merger of RBC Global Asset Management (UK) and BlueBay in April 2023, BlueBay’s separate PRI signatory status has lapsed (including its annual reporting obligations).

2 In 2023, RBC GAM consolidated the activities of two regulated legal entities in the United Kingdom (UK), RBC GAM-UK and BlueBay Asset Management LLP (BlueBay), into RBC GAM-UK. BlueBay’s stewardship activities have been incorporated throughout RBC GAM’s Annual Stewardship Reports since the 2022 version.