Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

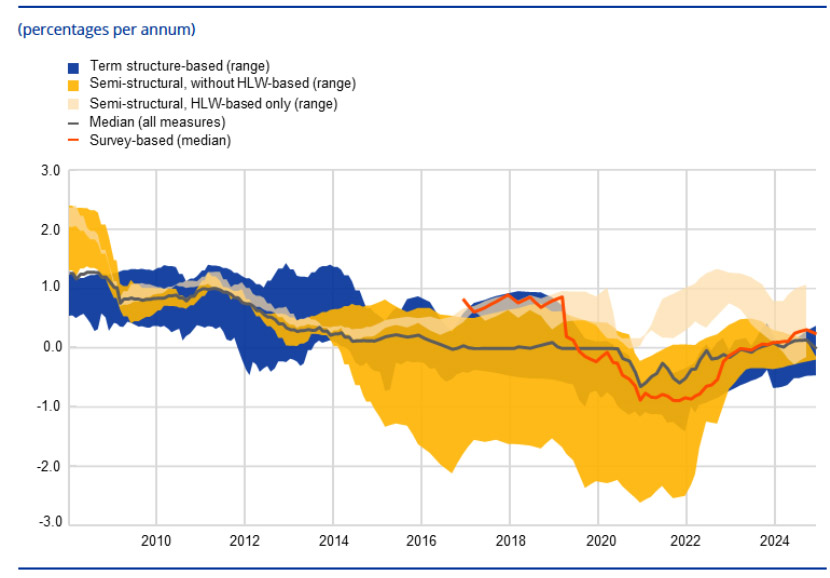

Where we stand: at the last ECB meeting, President Christine Lagarde reinforced the current policy stance, stating that “the disinflationary process is over.” She pointed to resilience in the domestic economy, a strong labour market, and a more balanced risk outlook.

Reality check: yet, any sign of economic softness, particularly on the price front, could embolden the doves to push for further easing.

By the numbers: current estimates of the neutral interest rate (r*) range from 1.75% to 2.25%. ECB staff projections peg inflation at 1.9% by 2027. Wage growth is forecast at 4.6% in 2024 and 3.2% in 2025, based on 47.9% coverage.

The bottom line: another 25bps cut early next year is feasible without straying from a ‘neutral’ policy stance.

Source: ECB, as at September 2025.

Source: ECB, as at September 2025.

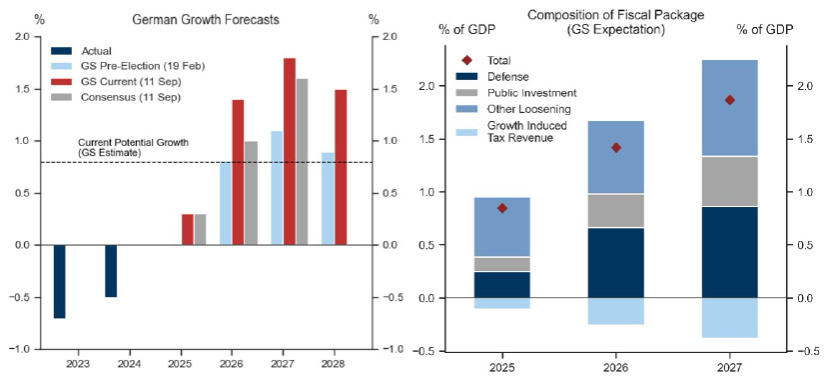

What they’re saying: Goldman Sachs remains optimistic about Germany’s economic prospects, projecting GDP growth roughly 0.5 percentage points above consensus forecasts.

The big picture: political infighting, global trade headwinds, elevated energy costs, and underinvestment in high-tech sectors continue to weigh on momentum. However, the overall trajectory remains upward.

Context: Germany’s rearmament drive is set to deliver significant benefits to European industry. Domestically, efforts to improve supply chains and upgrade infrastructure are poised to enhance long-term growth potential.

What’s next: Europe’s structural transformation is still in its early stages. The first comprehensive audit of the Draghi Report recommendations reveals limited progress: only 11.2% of 383 recommendations have been fully implemented, rising to 31.4% if partial implementations are included. Most remain works in progress.

Source: Goldman Sachs, as at September 2025.

Source: Goldman Sachs, as at September 2025.

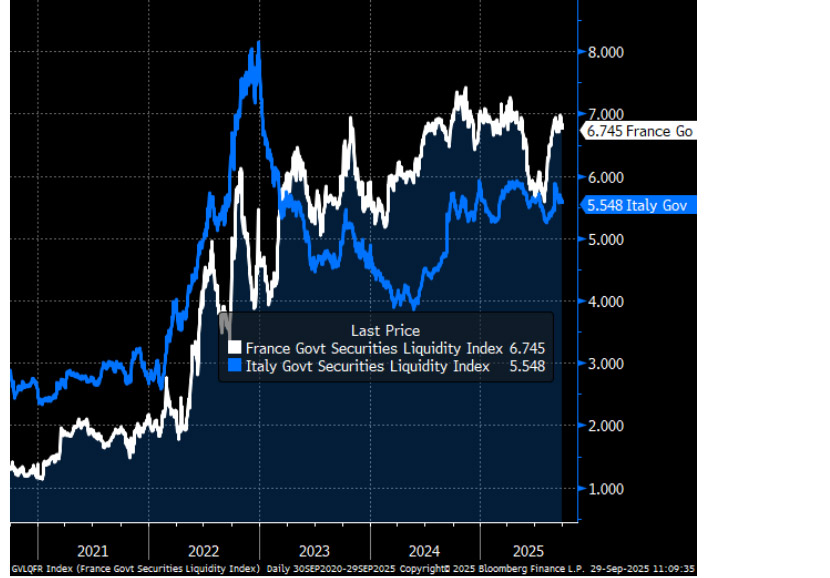

Where we stand: France’s swollen budget deficit, a lingering consequence of the pandemic, highlights successive governments’ failure to rein in spending amid weak economic growth. The new PM faces a daunting task to pass a budget much like his predecessors.

Reality check: political uncertainty and deadlock often triggers markets to price in worst-case scenarios. In such moments, reduced liquidity can amplify the situation, causing spreads to spike sharply in a self-reinforcing cycle.

Why it matters: markets tend to trade against positions, driving spread overshoots. For investors, the best alpha opportunities typically emerge when these trends begin to reverse.

The bottom line: a robust framework for assessing medium- to long-term fair value is essential, offering a reliable anchor for investment decisions during volatile periods.

Source: Bloomberg, as at September 2025.

Source: Bloomberg, as at September 2025.

The big picture: France’s fiscal trajectory has been uniquely idiosyncratic, with bond spreads widening back towards 2024 levels. This contrasts starkly with the broader Eurozone, where government bond spreads have narrowed in recent weeks. Italian 10-year BTPs, once seen as riskier assets, have reached levels not seen since 2008.

Where we stand: the Eurozone periphery, once defined by high debt, soaring unemployment, political instability, and fraught relations with Brussels, has undergone a striking transformation.

Reality check: under Giorgia Meloni, Italy has achieved greater stability and direction. Greece has sharply reduced its debt burden and regained investment grade status. Spain has become one of Europe’s fastest-growing major economies, while Ireland has strengthened its EU ties post-Brexit.

Implications: the traditional core-periphery divide has never been less relevant, with the widest and tightest eurozone sovereign bond spreads now separated by just 60bps.

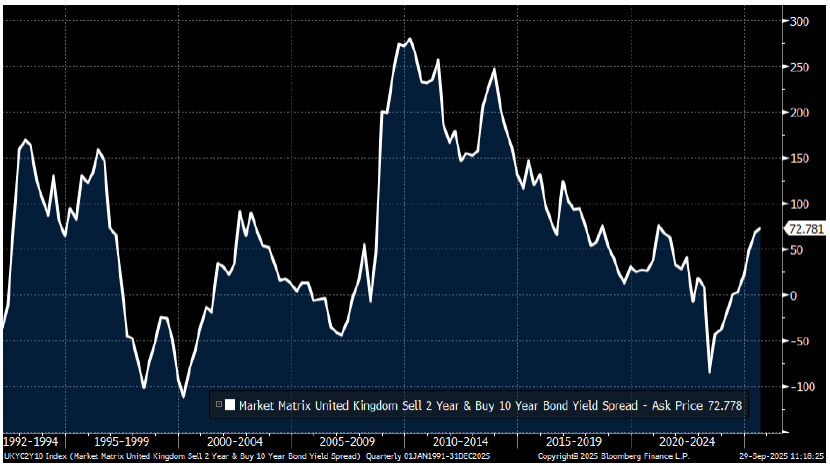

Zoom out: the long end of the gilt market is precariously balanced, with mounting risks from both inflation and government spending.

Reality check: any missteps in controlling inflation or maintaining fiscal discipline could push long-end yields above 6%, steepening the curve dramatically.

Implications: for investors, the short end of the curve may present a safer option. The BoE governor remains adamant the next step remains another cut in policy rates, with one eye on a dubious labour market.

Bottom line: the market is pricing one more additional cut over the next five MPC meetings. As we have seen in the past, these extreme pricing directions don’t last very long.

Source: Bloomberg, as at September 2025.

Source: Bloomberg, as at September 2025.

All data sourced from Bloomberg, as at September 2025, unless otherwise stated.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.