Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Zoom out: the ECB is largely satisfied with its current policy stance, as inflation hovers above 2% and the risk of economic overheating remains low.

By the numbers: markets are pricing in very little in terms of rate cuts over the next four ECB meetings – a mere 8bps.

Where we stand: the ECB is operating in "risk management" mode, meaning any signs of significant downside growth risks could trigger a swift re-pricing in market expectations.

What they’re saying: some policymakers argue that a 2028 inflation projection below 2% – at the December meeting – could justify re-opening rate cut discussions.

The bottom line: it isn’t the base case but should inflation – led by wages – slow further and growth disappoint, don’t be surprised if the rate cut debate heats up again.

The big picture: the Eurozone’s creditworthiness is improving overall, led by rating upgrades (e.g. Spain, Italy, Greece) outpacing downgrades (e.g. France, Belgium) in recent quarters.

By the numbers: the generic 10-year EU bond trades in the ‘middle of the pack’ versus peers, yielding 3.1%, despite its superior rating.

Context: issuance will remain relatively high, but the launch of the EU bond future is a stepping stone in bolstering liquidity, creating a favourable environment for EU bonds.

What’s next: expect more credit convergence, and in turn, strong supranationals like the EU to converge with the strongest names in the area, such as Austria.

Source: Bloomberg, as at 3 November 2025.

The big picture: Sweden’s economic outlook is improving, with lower rates, rising sentiment, and a shift towards expansionary fiscal policy expected to boost growth.

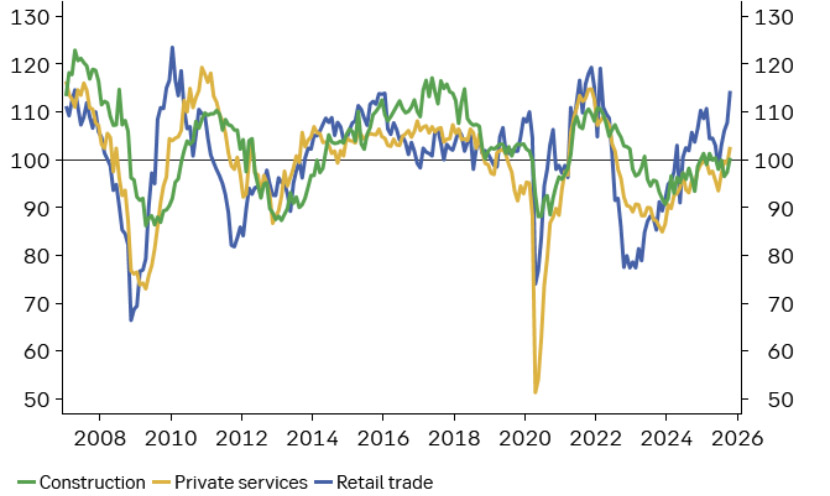

Zoom in: the Economic Sentiment Indicator (ESI) climbed in October, surpassing normal levels for the first time since mid-2022. Retail confidence is also near historical highs.

Context: Sweden is pivoting away from years of austerity, with fiscal policy in 2026 set to be highly expansionary. JPMorgan estimates a fiscal thrust of 0.7% for 2026, based on budget item multipliers.

The bottom line: Sweden’s policy shift and improving sentiment signal a favourable outlook, positioning the country for stronger growth in 2026, something Riksbank policymakers will be fully aware of.

Source: SEB, as at November 2025.

The big picture: cash credit spreads are at multi-year lows, appearing unremarkable on the surface.

Zoom in: while overall spreads may seem unappealing, sectors like European banks with robust fundamentals and improving metrics, offer compelling opportunities for selective positioning.

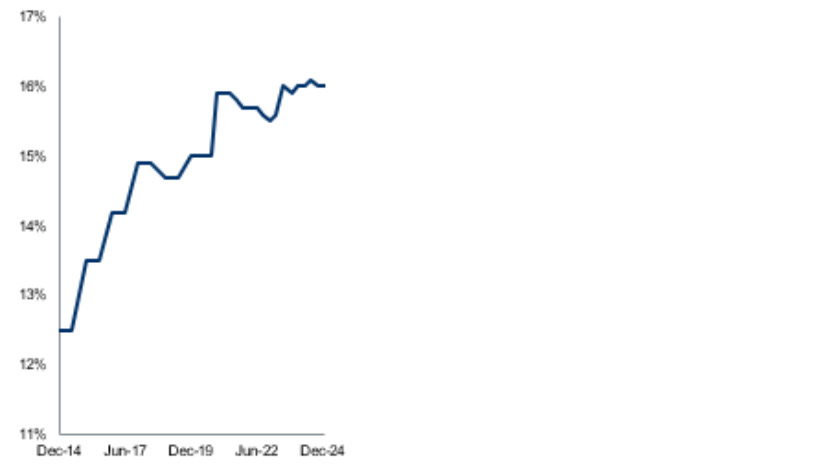

By the numbers: we have seen CET1 ratios rising from 12.5% in 2014 to 16% today. Return on investment has climbed from 4% to 10%, while non-performing loans have dropped significantly from 6.5% to 2% in the same time period.

Context: the sector has benefited from normalised interest rates, driving a 70% surge in profitability.

The bottom line: investors should look beyond headline spreads to identify resilient sectors, such as European banks, that can deliver strong returns in the current environment.

Source: RBC GAM, as at December 2024.

The big picture: UK 10-year gilts have performed well recently, supported by softer wage and inflation data, alongside government signals of potential energy cost relief.

Context: ongoing "drip-feed" announcements of potential budget policies, including tax hikes for the wealthy, have pressured the pound on concerns they will be detrimental on growth.

Why it matters: the Labour government needs to thread the needle between raising enough money to balance the books and tax hikes that can be digested without any negative growth feedback.

The bottom line: headline inflation has improved, but is still 3.8% (Services is 4.7%), nearly double the Bank of England target. Meanwhile, growth is teetering and needs a boost. The threat of stagflation is there for all to see.

Source: Bloomberg, as at 3 November 2025.

All data sourced from Bloomberg, as at October 2025, unless otherwise stated.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.