Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways:

There’s an old saying in financial markets – “When Wall Street sneezes, the world catches a cold”. For decades, US markets have been the epicentre of global investing, setting the pace, direction and tone for risk appetite everywhere else. However, in 2025, that gravitational pull may be weakening.

Confidence in the US – economically, fiscally and politically – is starting to fray. Trade policy is increasingly erratic. The fiscal trajectory is unclear. Markets have already responded with volatility, and investors are questioning whether the US can still offer the clarity and stability that once set it apart.

Political uncertainty, fiscal expansion and shifting trade rhetoric are prompting a reassessment of US risk. After the so-called “Liberation Day” tariff announcements triggered a broad market correction, the US administration softened its stance, pausing implementation and entering negotiations with key trade partners. More recently, court challenges have thrown fresh uncertainty over whether the proposed measures can be implemented at all.

Meanwhile, a disappointing Treasury auction in May highlighted investor unease at the scale of America’s unfunded spending plans – and, more broadly, at the lack of policy clarity. Though subsequent auctions have been better received, the episode served as a reminder that even the world’s largest economy cannot take market confidence for granted. That point was underlined by Moody’s’ decision to downgrade the US sovereign credit rating – a move that reflects mounting concern over persistent deficits and an expanding debt burden.

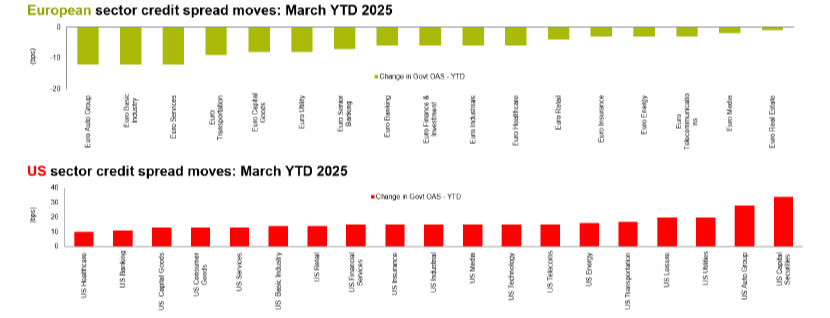

In credit markets, that shift in sentiment is beginning to be evident in the data. As the chart below illustrates, US spreads have widened relative to European peers. US credit still represents a large and liquid market, but for many investors, it may no longer be the obvious starting point it once appeared.

Source: Bloomberg, BofA index data, as at 31 March 2025.

Excess return is the return for holding corporate bonds over the return for underlying bunds.

European credit, by contrast, is quietly gathering momentum. While global policy uncertainty remains in the background, there are early signs of improving economic sentiment in Europe, supported by a more proactive policy approach. Germany’s plans for a significant fiscal expansion – marking a departure from its traditionally conservative stance – have been welcomed by markets. Defence budgets are rising across the region too, with European NATO members stepping up spending commitments. Together, these shifts point to a more constructive growth outlook than many had anticipated.

Crucially, spreads in Europe have tightened, even in the face of the macro noise. That compression reflects improving fundamentals but also a growing awareness that Europe may now offer a more attractive hunting ground for credit investors.

This divergence in spreads – with European yields tightening even as US spreads widen – reflects a broader reappraisal by global investors. As confidence in US policy clarity wanes, capital is starting to flow towards markets where valuations and policy signals appear more supportive.

We believe this may have further to run. Our portfolios already reflect a view that the European opportunity set is becoming more attractive. Our investment grade credit strategies are increasingly underweight the US, in favour of Europe.

The winds of change are currently blowing through financial markets, but it may still be too early to decisively call the end of US exceptionalism. Nevertheless, the fact that we – and many other investors – are even calling it into question is significant. The US still plays a central role in global markets. However, the automatic assumption of American leadership that has been in place for so long – across policy, economic management and financial markets – is looking increasingly challenged.

The old adage mentioned above that “When Wall Street sneezes, the world catches cold” is also being doubted. Wall Street has clearly sneezed this year, but so far, the rest of the world looks surprisingly healthy. Investors appear increasingly well immunised to Wall Street’s viral reflexes. Not completely indifferent, but more selective in their response.

For those willing to embrace a more global opportunity set in investment grade credit, therefore, the scope to add value is expanding.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2025 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.