Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

There are several key benefits that investors find attractive within emerging market debt (EMD), including diversification, yield premium and a fertile opportunity for compelling returns by sourcing alpha opportunities.

Emerging markets provide investors with access to a wider array of different economies at distinct stages of their economic cycle and, consequently, a richer variety of idiosyncratic returns drivers which can be uncorrelated to developed market economies, and often to each other. This geographical and macro-economic breadth allows for the creation of more diversified portfolios. Due to the breadth of the opportunity set, it becomes possible to find uncorrelated, idiosyncratic stories, which is particularly valuable within the context of diversifying your portfolio.

Also, the diverse economic makeup of different emerging markets can mean that some can benefit from macroeconomic trends that weigh on most developed markets. An energy price spike, for example, would boost the prospects of commodities exporters. Over time, EM bonds have provided investors with differentiated returns relative to DMs, showing modest correlation to global equities and global bonds. The result being ample diversification benefits for institutional investors which can serve as an important buffer during periods of stress or volatility in other regions or asset classes.

EMD has provided investors with a meaningful yield advantage over developed market bonds, compensating them for venturing out of their core markets and providing an effective cushion against market volatility.

Yields range from 6-7% at the index level and rise to greater than 8% when investors look at instruments rated single-B or below.

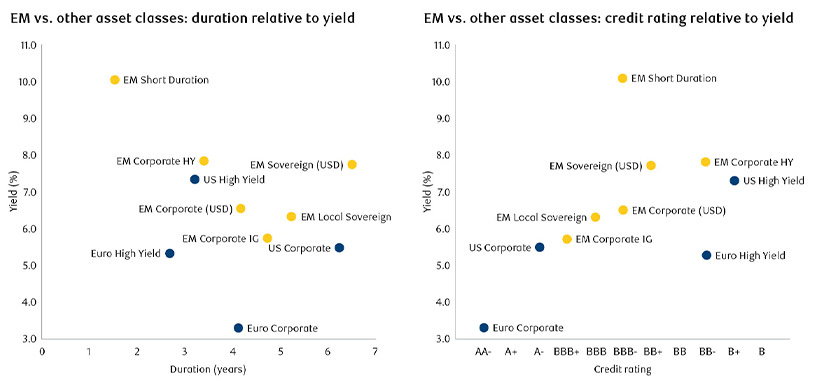

This attractive yield premium offered by EMD is apparent when comparing the asset class against developed market instruments with similar rating and duration risk profiles (see Figure 1).

Source: JPMorgan, BofA, Bloomberg. as at 31 January 2025.

Note: EM Corporate (USD) = JPM CEMBI Diversified; EM Sovereign (USD) = JPM EMBI Global Diversified; EM Local Sovereign = JPM GBI-EM Global Diversified USD unhedged; US High Yield = BofA US High Yield Master II; US Corporate = BofA US Corporate Master; Euro High Yield = BofA Euro HY Index; Euro Corporate = BofA Euro Corporate Index; EM Corporate HY = JPM CEMBI Diversified HY, and EM Corporate IG = JPM CEMBI Diversified IG.

For clients who believe in the benefit of active management they need to look no further than emerging market debt, which provides a fertile a hunting ground for sourcing alpha opportunities. The market can be inefficient and less well understood, as many market participants do not have the resource and expertise to analyse all the risks (and opportunities) and properly price these securities. As a result, specialist active managers can be presented with a ‘dream scenario’, to exploit the price anomaliesthat emerge.

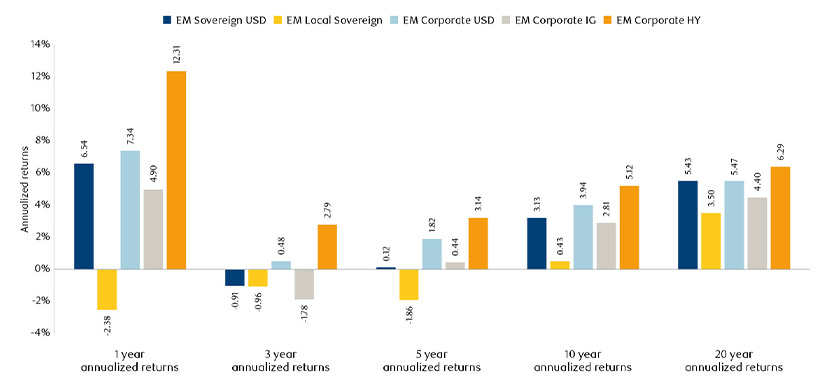

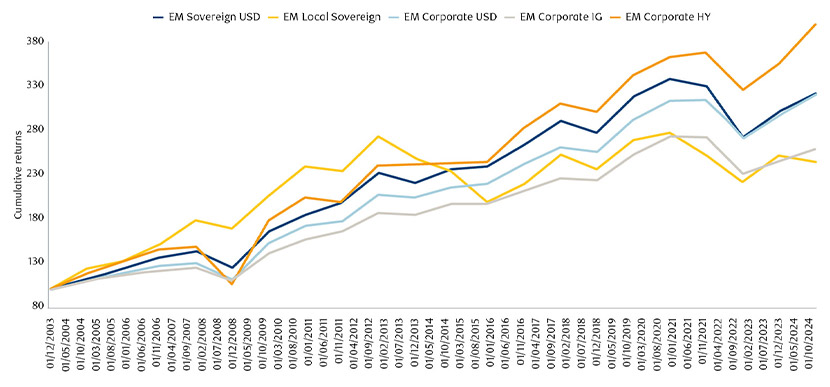

EMs are by their nature subject to swings in sentiment and to external economic and geopolitical events. We believe the wide range of issuers and asset characteristics can create opportunities for enhanced returns through active management as markets overreact in the short term to news flow. The range of exploitable returns can vary across sub-asset classes, depending on the context and market developments. Figures 2 & 3 demonstrate the competitive results achieved by EMD over time.

Source: Bloomberg, as at 31 December 2024

Source: Bloomberg, as at 31 December 2024.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.