Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the International Monetary Fund (IMF) with the remaining classified as ‘emerging market and developing’.

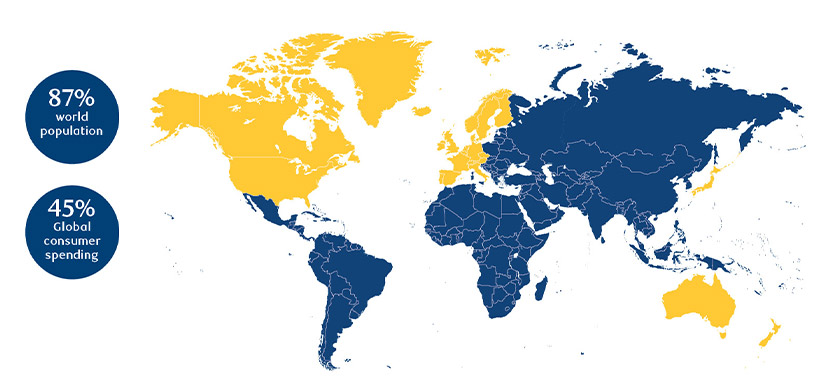

Combined, emerging market economies account for over 50% of global Gross Domestic Product (GDP), 45% of global consumer spending and roughly 87% of the world’s population2. The EM debt universe comprises four primary sub-classes: hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

Source: RBC GAM, as at December 2024.

Despite being the world’s largest pool of credit, at $29 trillion in size, EMD or emerging market debt remains one of the most misunderstood markets amongst investors, not only in terms of composition of the asset class but also the risk-reward profile of the underlying assets. Indeed, asset allocators and investors alike are often surprised to discover the breadth, versatility and return opportunities the asset class can offer their portfolios and, moreover, the fundamental and liquidity characteristics of various sub-asset classes.

In the note below, we provide an overview of EMD, summarizing the distinct sub-asset classes that offer differentiated risk-return characteristics that can potentially enhance portfolio outcomes.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Although there is no official definition, within capital markets the term ‘emerging markets’ is generally used to refer to countries with lower per capita income and limited integration within the global financial system.

While they have may have an established financial infrastructure, the institutional strengths and market characteristics of these emerging markets may not be on par with the efficiency, accounting standards or securities regulations of ‘developed’ nations.

Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the IMF with the remaining classified as ‘emerging market and developing’. These countries are widely dispersed across Latin America, Asia, Eastern Europe, the Middle East and Africa, and range in size from giants like China and India to much smaller countries such as Belize and Ivory Coast. Combined, emerging market economies account for over 50% of global GDP, 45% of global consumer spending and roughly 87% of the world’s population.

Source: Oxford Economics and the IMF, as at 30 September 2024

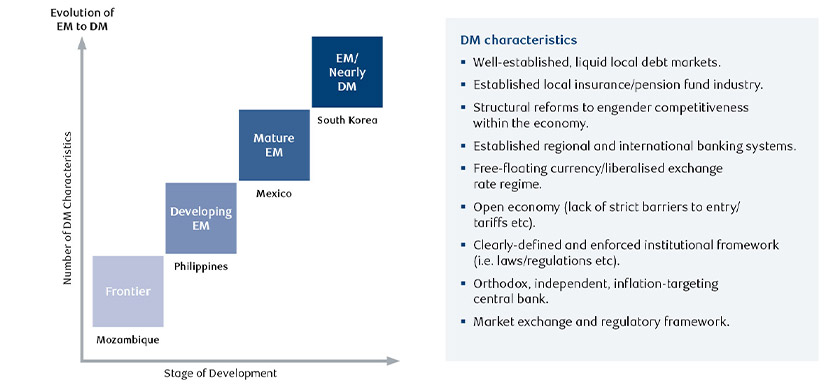

Market liquidity and governance factors have historically been a key factor in defining classification. Some countries such as South Korea are considered developed by the IMF but deemed as emerging by some market participants. Likewise, some EM countries, such as Brazil, China, and India rank amongst the world’s largest economies, but are considered by most as emerging economies. At the opposite end of the spectrum there are frontier markets (less developed economies) such as Mozambique, which are typically smaller and have less liquid capital markets.

Clearly these markets will not have progressed as far down the path as today’s developed markets (DM), and as such, debt from these economies will be subject to a higher level of risk premia than their developed counterparts, thus rewarding investors with a higher yield. Figure 3 shows the stages of development as emerging countries transition towards developed market status.

Source: BlueBay Asset Management

The size and sophistication of the investable universe of debt issued in emerging countries has increased substantially over the last 30 years. EM debt was once issued only sporadically and in US dollar denominations, but today far fewer EM governments require support from G-7 nations for their funding and are able to access the international capital markets directly. Moreover, because of strong internal growth, economic development and favourable macroeconomic factors, many EM sovereigns have also developed deeper domestic capital markets. This has, in many cases, translated into a significant shift to local currency debt issuance.

The EM debt universe comprises four primary sub-classes and accounts for nearly US$29 trillion3. This is a large heterogenous asset class with debt issued in both hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

The following compares the key characteristics of the four main sub-asset classes:

The EM hard currency sovereign sub-class is the oldest and most established going back to the Brady bond era in the early 1990s. The market has since evolved significantly, presenting a broad opportunity set for investors. Not surprisingly, it has the largest group of managers involved and is more familiar to many investors.

These bonds have a global investor base and tend to trade at a spread over US Treasuries and are therefore much more sensitive to US rates. Compared to local currency bonds, hard currency bonds also tend to have longer maturities and larger issuance sizes, making them easier to trade on the secondary market. The depth of the market and diverse set of participants, including local and foreign investors, translates into higher trade volumes and strong liquidity levels.

The hard currency EM corporate debt market is a diverse and very well-established asset class which has seen strong growth in the last decade, driven by robust investor demand, rapid long-term EM economic growth, and increasing integration into global capital markets. Despite being a majority investment grade (IG) rated asset class, EM corporate debt has offered higher yield over similarly rated DM corporates, a reflection of the higher risk premium investors typically require when investing in EM. However, investor perception of risk in emerging markets is changing as corporate governance and transparency continue to improve and macro policy across the EM universe has become more orthodox.

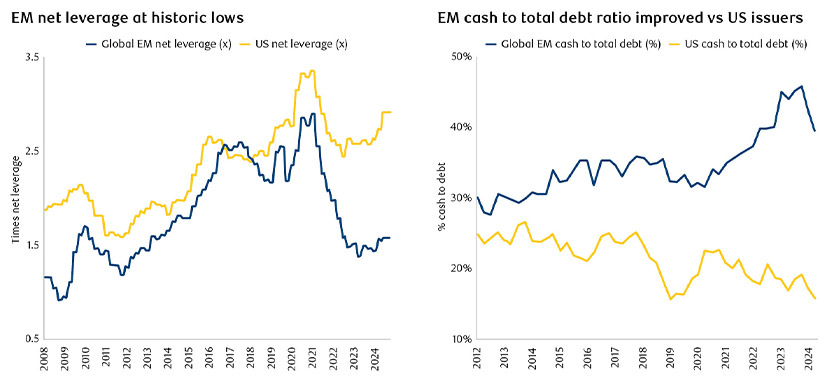

At a company level, fundamentals have seen considerable improvement over the last few years as EM corporates have consistently reported lower leverage and higher cash to total debt ratios than their US counterparts. Currently, the difference in net leverage and cash to debt ratio in EM vs DM (using US corporates as a proxy) stands above 10-year highs (Figure 4).

Source: Bank of America, Merrill Lynch, as at 31 December 2024.

The EM local currency market is a vast, rapidly growing universe. The range includes countries that are more mature, with a full scope of liquid cash and derivative instruments, to markets that are considered ‘frontier’, embarking on a long and difficult process of opening their capital accounts and deepening their local markets to attract foreign capital.

Opportunities for diversification are vast, with a multitude of sovereign and corporate issuers, inflation-linked and nominal debt, free floating to managed or pegged currencies. Debt denominated in local EM currencies typically have shorter duration and are more influenced by local inflation expectations and central bank policies. Investors in EM local currency debt tend to be domestic market participants and specialized EM funds.

Despite the breadth of the opportunity set, the most widely used index – the JPM GBI-EM Global Diversified Index Unhedged – reflects only a very specific subset of the universe, limited to the larger, more liquid markets. The price for limiting the benchmark to this subset, however, is that it has become a very concentrated and highly volatile point of reference for the market. Indeed, this detracts from the very specific diversification benefits which draw investors to this asset class in the first place.

The EM local currency corporate debt market, in its broadest form, covers over 80% of the global EM debt universe, with local capital markets in varying stages of development. This ranges from more mature EM countries, such as Brazil and Mexico, to markets that are considered frontier, such as Kazakhstan, and which can offer idiosyncratic opportunities. Local currency corporates typically offer higher yields when compared to local currency sovereigns due to the additional credit risk, and they are often less liquid with fragmented issuance across different countries and regulatory frameworks.

In addition, while governments actively seek foreign investment for local currency sovereign bonds, corporate debt tends to have greater restriction on foreign investor participation. These challenges combined have limited the level of foreign investor sponsorship of the local currency EM corporate sub-asset class, despite the overall higher credit ratings and lower duration risk.

1 JPMorgan, RBC BlueBay Asset Management, as at December 2024.

2 IMF, as at Q3 2024.

3 JPMorgan, as at 31 December 2024.

4 RBC Global Asset Management, as at 31 December 2024.

5 Quasi-sovereign: an entity that is 100% guaranteed by a sovereign or majority owned or controlled by a sovereign.

6 RBC Global Asset Management, as at 31 December 2024.

7, 8 RBC Global Asset Management, as at 31 December 2024.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.