Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways

Exasperated by how bond markets were reining in the Clinton administration’s US economic agenda in 1993, political strategist James Carville remarked “I used to think that if there was reincarnation, I wanted to come back as the president or the pope. But now I want to come back as the bond market – you can intimidate everybody.” More than 30 years later, it continues to feel apt.

Today, it’s not just fiscal orthodoxy that markets are baulking at – it’s stability itself. Tariffs, shifting rhetoric, and political unpredictability are generating the kind of policy-driven volatility that’s difficult to model and harder still to ignore. Ironically, the US administration’s approach looks less like “Make America Great Again” and more like “Make Volatility Great Again.”

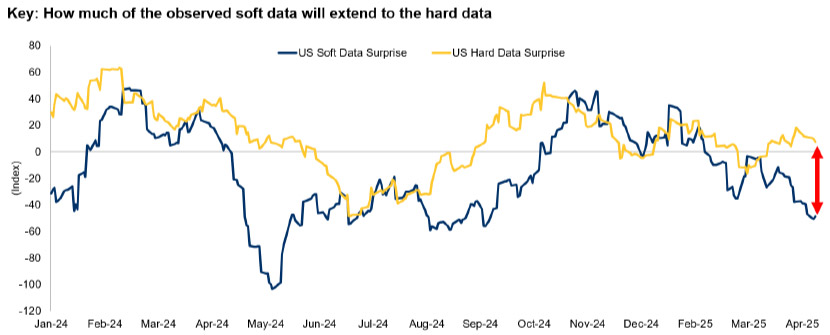

The effects are already visible. Soft data has started to weaken and, although hard data has thus far held up, history suggests this kind of divergence rarely lasts. Either expectations rebound, or activity slows.

Tariffs are causing uncertainty and falling confidence in the US

Source: Citigroup, as at April 2025.

Volatility has picked up, but the fundamentals for investment grade credit remain sound. Default rates are low, balance sheets are generally healthy, and in selective parts of the market, yields offer more than reasonable compensation for the risks involved. Global growth is likely to slow, but our base case is that we avoid recession. While not without risks, this scenario remains broadly supportive for the asset class.

While the policy backdrop remains noisy – particularly around tariffs – the US administration has clearly softened its stance since the initial “Liberation Day” announcements. Market reactions have likely encouraged the shift to a more pragmatic stance, suggesting that, like in 1993, investors are collectively helping to define the boundaries of what is politically and economically viable. The disappointing reception to the US Treasury auction earlier this month represents another reminder that there are limits to what the market will tolerate.

In our view, this is not a time to stand back. It’s a time to be selective.

Volatility in 2025 isn’t indiscriminate. It’s creating meaningful divergence between sectors, with policy uncertainty acting as a key driver. Credit spreads are adjusting in different directions depending on how exposed companies are to global trade, how reliant they are on complex supply chains, and how sensitive they are to shifts in economic momentum.

Take European autos and industrials. These sectors are being hit by a combination of weaker sentiment, softer demand and growing concerns around export disruption. As large-scale producers often reliant on complex supply chains, they are particularly exposed to tariffs and rising input costs. That pressure is visible in the data, where confidence indicators have turned lower, and in market pricing, with spreads widening.

By contrast, areas like aerospace and defence are benefiting from the prospect of increased government spending and the emergence of a new, potentially long-term, trend towards rearmament, particularly in Europe. These sectors have strong order books and supportive policy momentum. Banks, too, continue to offer resilience. Capital buffers remain robust, profitability has improved, and non-performing loans are near record lows. In short, the fundamentals for financial credit look stronger than for many years.

This kind of dispersion isn’t new, but it is to be welcomed by active credit investors like ourselves, because it provides a broader set of opportunities to generate returns through selective positioning, rather than relying on broad market direction.

Volatility is likely to remain a defining feature of markets in the months ahead – not just because of what’s happening in the real economy, but because of the policy uncertainty surrounding it. At the same time, dispersion is widening. Pricing across sectors, capital structures and regions is increasingly differentiated.

For active credit investors, that creates opportunity. It’s the kind of environment that plays to the strengths of a flexible, selective approach. We’ve positioned our strategies accordingly – adding exposure where the backdrop looks supportive and avoiding the areas most vulnerable to the pressures now unfolding.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.