Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Zoom in: the EU accepted a 15% tariff on imports (plus some investment intention) in exchange for zero tariffs on exports to the US.

What they're saying: leading economists, including Olivier Blanchard, have criticised the agreement, stating ‘asymmetric 15% tariffs represent a defeat for the EU.’ French Prime Minister François Bayrou voiced similar concerns, echoing widespread discontent among a certain sect of European leaders.

Reality check: Europe approached the negotiations from a position of weakness, constrained by vulnerabilities in key sectors such as automotive manufacturing and security.

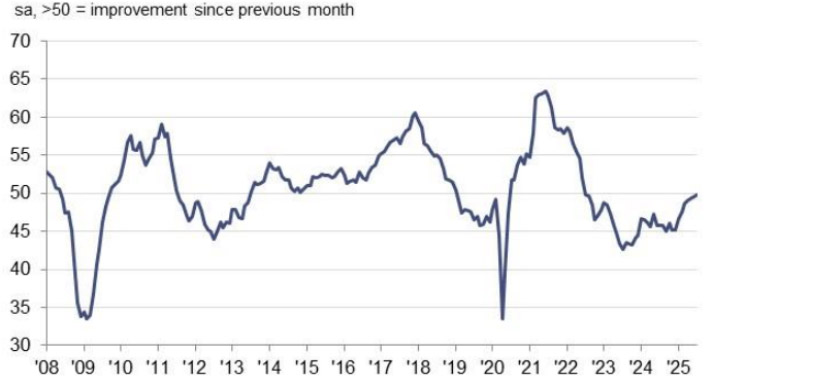

What’s next: with the deal concluded, Europe can now turn its attention to broader priorities. The European Central Bank (ECB) has normalised interest rates, Germany is preparing to inject €1 trillion into its economy, and the manufacturing sector is gaining some momentum (Purchasing Managers’ Index is now ~50).

Bottom line: this deal is less about triumph or failure and more about moving forward.

Source: S&P Global, as at 2025. Sa = seasonal adjustment.

Zoom out: in an early July interview, ECB Council member Isabel Schnabel stated that the bar for another rate cut is ‘very high’, noting that risks to the euro area’s growth outlook have become more balanced.

Zoom in: President Christine Lagarde reinforced this view, adding that the ECB would not be swayed by minor deviations in inflation or growth, and policy is set with an eye on the medium term.

Between the lines: the ECB believes it has struck the right balance, with monetary policy neither overly restrictive nor overly accommodative. Any adjustments now, they suggest, would be driven primarily by risk management considerations.

What’s next: it would take a significant supply-side shock to push inflation into reverse. While Lagarde has not ruled out a shift towards considering rate hikes, the bias remains towards easing further.

Implications: as rate cuts get pushed further out, the odds of the next cut being in 2026 as opposed to this year grow.

Reality check: Dutch pension fund reforms will reduce demand for long-term sovereign bonds, with funds shifting to higher return assets like equities and credit.

By the numbers: the FT reported Dutch pension funds plan to sell €125 billion in long-dated bonds this year due to retirement sector reforms. ING estimates a €500 million dollar duration impact from Dutch pension reform unwinding interest rate hedges.

Why it matters: increased issuance, reduced ECB support, and structural shifts in demand could destabilise long-end bond markets.

The bottom line: Barclays projects €1.5 trillion in gross European sovereign bond issuance by 20261; long-end European rates face mounting pressure from both fundamental and technical factors, requiring careful monitoring.

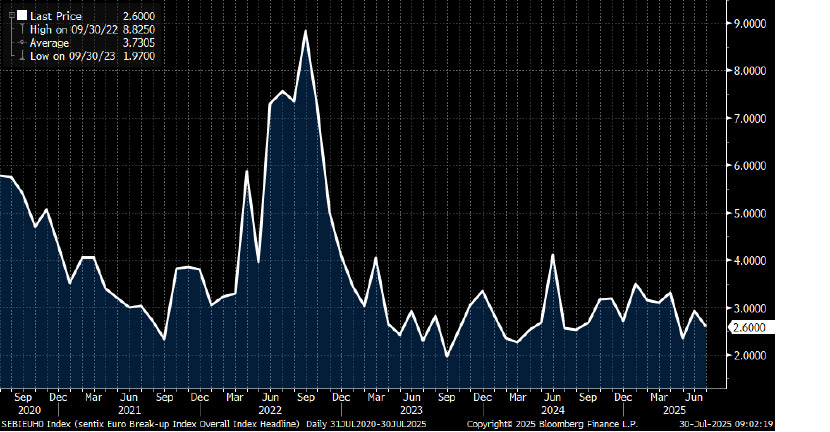

Source: Bloomberg, as at July 2025.

Where we stand: geopolitical uncertainty and shifts in global trade rules have further strengthened European institutions. Initiatives like the Strategic Autonomy and Defence of Europe (SAFE) programme are driving deeper integration, while the ECB continues to provide monetary support.

The big picture: the Sentix Euro Break-up Index, which measures the probability of a euro area country exiting the euro within 12 months, is at historic lows.

Between the lines: ample liquidity in the market is fuelling investor activity. Capital is being shifted and repatriated, with European fixed income emerging as a key beneficiary.

Why it matters: tighter spreads signal confidence in European cohesion, but investors must remain vigilant in a fragile global environment.

Implications: history has taught us that a decline in scepticism, a dearth of risk aversion and the generally positive mood calls for prudence as markets can shift unexpectedly.

Source: Sentix, Bloomberg, as at July 2025.

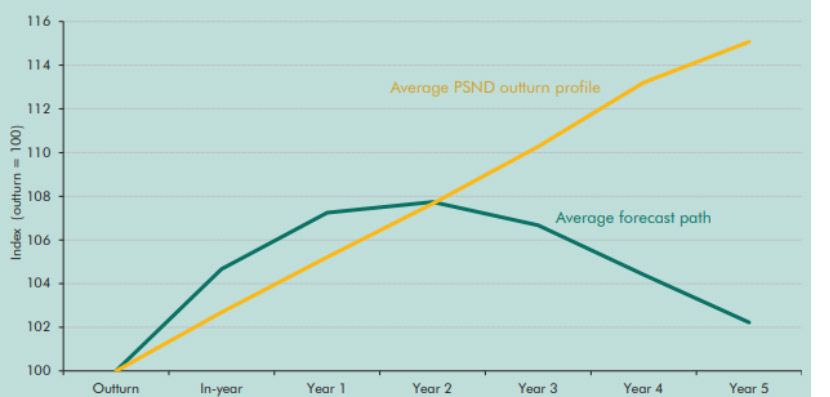

Context: a report from the Office for Budget Responsibility (OBR) has laid bare the harsh realities of spiralling debt and persistent mismanagement of public finances.

Zoom in: the report identifies three major long-term fiscal risks: an ageing population, rising pension costs, and the financial demands of climate change.

By the numbers: national debt is projected to soar to 270% of GDP by 2070, far exceeding sustainable levels, if current trends go unchecked. Markets have latched on, with UK 10-year gilt yields the highest in the G7.

Reality check: the Government’s abandonment of planned spending cuts is another example of short-termism in the political arena.

Between the lines: the UK is paying the price for poor inflation control, excessive borrowing, and unsustainable spending under successive governments.

The bottom line: without urgent reforms to address long-term fiscal risks, the UK’s debt trajectory and economic resilience remain on shaky ground.

Source: OBR, as at 2025

All data sourced from Bloomberg, as at July 2025, unless otherwise stated.

1 Barclays Research, July 2025.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.