Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Where we stand: the ECB cut policy rates eight times across 2024-2025. Rates now sit at 2%, widely considered the ‘neutral’ level.

What they're saying: markets are pricing a full 25bps hike by end-2027. Some council members, notably the arch-hawk, Schnabel, are comfortable with that.

Reality check: after the supply-shock induced inflation surge in 2022, many policymakers are paranoid about a repeat scenario.

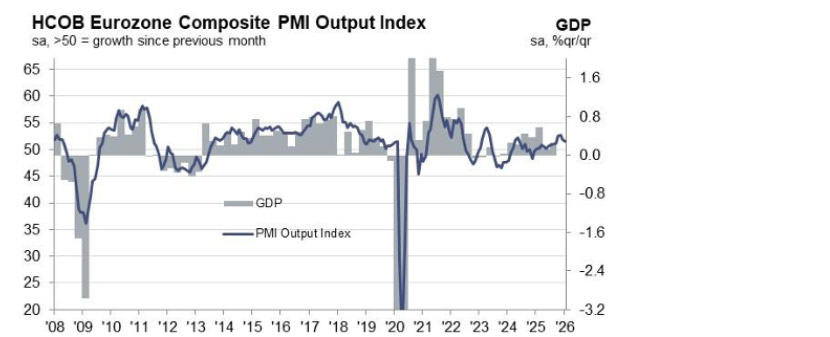

Big picture: growth is uninspiring (e.g. the latest PMI is just above 50), credit demand is tepid, and Europe is at a critical geopolitical juncture. The ECB can play an important role.

Implications: we think headline inflation will undershoot 2% in H1 2026, allowing the doves at the ECB to become louder.

Source: S&P Global, as at January 2026.

Between the lines: European government bond (EGB) investors have taken note, with further credit spread compression between the strongest and weakest sovereigns in the complex.

By the numbers: there is just a 75bps spread between the Netherlands (strongest) and Lithuania (weakest). This was as wide as 150bps in early 2025.

Bonus: despite longer-term political and fiscal problems, noise around France has dissipated after the passing of the budget (until 2027 at least).

Bottom line: the reach for yield has been fierce in 2026. The need for Europeans to be united in a fractious international environment has provided a tailwind for narrowing credit spreads in the EGB space.

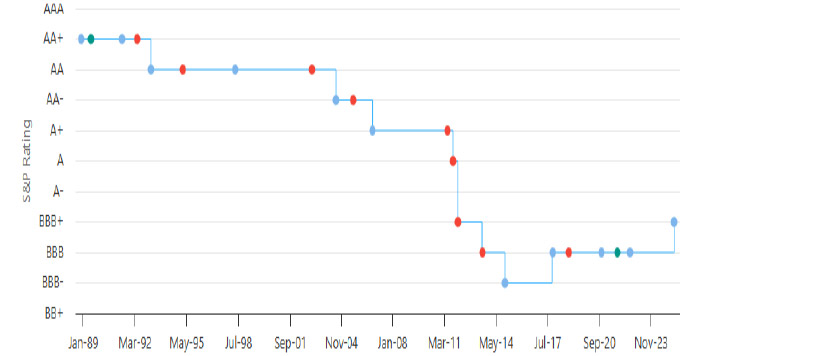

Where we stand: Italy is on a roll; a successful syndication earlier this month attracted orders exceeding EUR150 billion and recent investor meetings were notably upbeat.

Zoom out: political stability has proved highly beneficial, as have efforts to consolidate debt. The government expects positive primary balances of 1.2% in 2026, rising to 1.9% by 2029.

Zoom in: Italy has emerged as one of the market's preferred sovereign borrowers, with a broadening regional investor base, most notably from the Nordics and the Middle East.

Bottom line: Italy has a diverse mix of investors, including a strong retail presence. As the ECB steps away, international investors are happy to fill the gap.

Source: Highcharts.com, as at January 2026.

Zoom out: last summer, ECB vice president de Guindos said a EURUSD level above 1.20 would be ‘complicated’.

What they’re saying: 2026 has started with 1.20 under pressure. Other ECB members such as Villeroy and Kocher have already spoken out, highlighting the potential impact on inflation and the readiness to act.

Reality check: the trust in US policymaking is largely the narrative, accelerated recently by speculation around joint US-Japanese FX intervention. The truth is, euro trade-weighted has barely budged.

Why it matters: higher EURUSD feeds into costlier exports. According to GS, the largest European publicly listed companies derive 30% of their revenues from the US.

Bottom line: if the euro continues its ascent versus the US dollar, more ECB heads will turn.

Source: Bloomberg, as at January 2026.

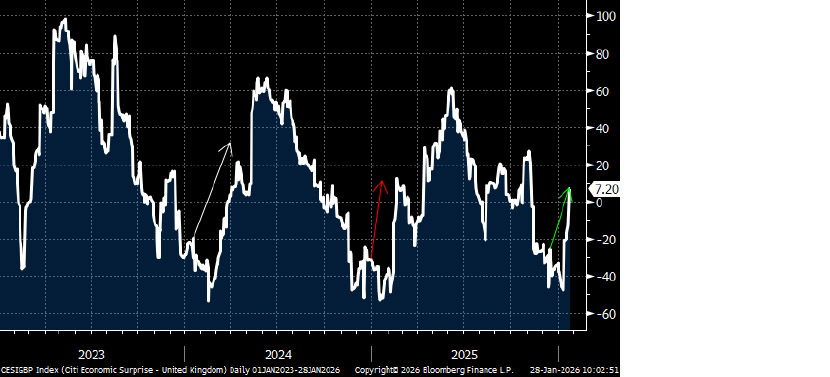

Where we stand: GDP, retail sales, and PMI data in January beat market expectations, confounding the generally bearish views of the UK economy.

Context: however, you could argue the strength is rather seasonal, given recent history, in which the UK economy starts the year strongly.

Reality check: the jobs market remains sluggish, with the latest unemployment rate holding above 5% and youth unemployment continuing to rise.

What’s next: the government remains entangled with geopolitics, domestic policy U-turns, and infighting. To make matters worse, inflationary pressures have stalled somewhat, according to the BRC.

Implications: the pound has moved sideways (versus the EUR) so far this year, but if growth tails off as the year moves on, and inflation remains stickier than expected, ‘the quid’ will have no choice but to bear the brunt.

Source: Bloomberg, as at January 2026.

All data sourced from Bloomberg, as at January 2026, unless otherwise stated.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.