Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways

Emerging market (EM) stocks have lagged their developed market (DM) counterparts since 2011, reversing their outperformance over the first decade of this century. The dollar’s strength over this period was a headwind for EM equities, while slowing EM earnings growth relative to many DM countries, particularly US tech stocks, was also a factor. However, 2025 has seen a turnaround, with the MSCI EM Index outperforming other regional equity indices over the first six months of the year.

It is perhaps surprising to look back at late 2024 forecasts and see that Donald Trump’s presidential re-election was anticipated to prolong the period of US exceptionalism. His business-friendly agenda was expected to be positive for the US economy and company earnings. Instead, his presidency has highlighted some of the weakness in the US economy.

President Trump’s proposed reciprocal tariffs and the subsequent trade negotiations have shown that the US’s bargaining position may not be as strong as he had hoped. The world has changed and other superpowers, such as China, India and Saudi Arabia, are rising to the fore. China, in particular, held its nerve during a series of tit-for-tat tariff hikes, sounding cool upon entering trade talks as it realised it could likely hurt the US more than the US could hurt China – especially when it comes to the supply of rare earth minerals so essential to the US tech supply chain.

Another Trump-related issue has been his ‘Big, Beautiful Bill’ which is expected to add at least USD3 trillion to the US budget deficit over the next decade1. Higher government borrowing means increased Treasury issuance. Historically, EM countries, such as China, have been willing buyers of US Treasuries, but this is changing: these countries are increasingly aware that there are other ways of responding to higher US tariffs without resorting to a trade war.

The dollar has been on a downward trend since US interest rates peaked in October 2023, but the deceleration has picked up pace since Trump returned to the White House. Recessionary fears, the US president’s repeated attacks on Federal Reserve Chairman Jay Powell’s refusal to slash interest rates, concerns over the size of the US budget deficit, and policy stability have all conspired to weaken the greenback.

While there is a general recognition that Trump’s policies require a weaker dollar to succeed, the speed of that depreciation is key. A gradual depreciation over the next few years would make US exports more competitive and persuade EM countries to import more from the US, helping to rebalance the global economy. So far this year, the US Dollar Index, a measure of the dollar’s value against a basket of its major trading partners, has fallen around 10%.

Uncertainty in the US has sparked interest in growth opportunities in other areas of the world. EM stocks, along with those in Europe, have been an area of focus. As well as future population growth, EM countries offer the largest opportunities for productivity gain and economic growth, as well as high-quality companies that can capture those opportunities and turn them into earnings growth.

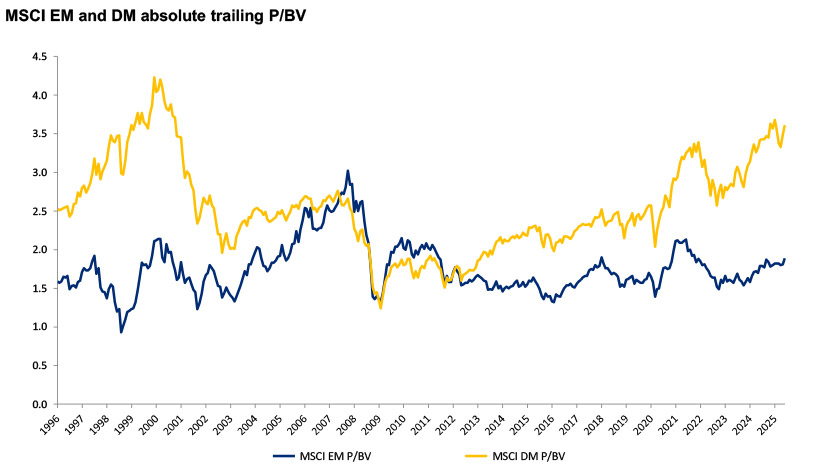

Yet, despite these favourable trends, EM stocks trade at a historically high discount of around 50% to US equities, as shown in the chart below. This compares to a 10% premium back in 2011.

Source: Bloomberg, MSCI, as at June 2025.

While we aren’t expecting a premium to return in the near future, we would estimate that fair value would be in the region of a 20% discount, given the amount of geopolitical uncertainty in the world at present. That still leaves significant upside potential for EM equities relative to US stocks.

Learn more about our EM Equity strategies here: Emerging Markets Equity | RBC BlueBay Asset Management

1 Committee for a Responsible Federal Budget forecast.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.