Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

However, understanding the relationship between inflation and interest rates is crucial in order to make informed investment decisions within this space.

In the IG asset class, core rates are a key driver of returns and inflation can have a significant impact on this.

Inflation picked up dramatically in 2021 after central governments eased financial conditions to counter the detrimental economic impact of the Covid virus. Legislation such as the Inflation Reduction Act in the US pumped fiscal stimulus into their domestic market, with similar initiatives undertaken across the UK and Europe. During the pandemic there had been a build-up of household savings and as the pandemic faded many consumers rushed to spend their savings leading to a huge increase in demand and a consequent jump in prices, as suppliers struggled to adjust.

Then followed the Russian invasion of Ukraine in 2022, which drove up prices for domestic staples like food and energy – causing a massive spike in inflation, and in reaction central banks raised interest rates on both sides of the Atlantic. As the world adjusted to these shocks and the impact of higher interest rates it affected both companies and consumers, and inflation eased considerably.

This type of action doesn’t mean prices reverse and start falling, but it does dampen the speed with which they rise to a more sustainable level although inflation levels in both the US and Eurozone still remain elevated in comparison to their pre-2021/22 levels.

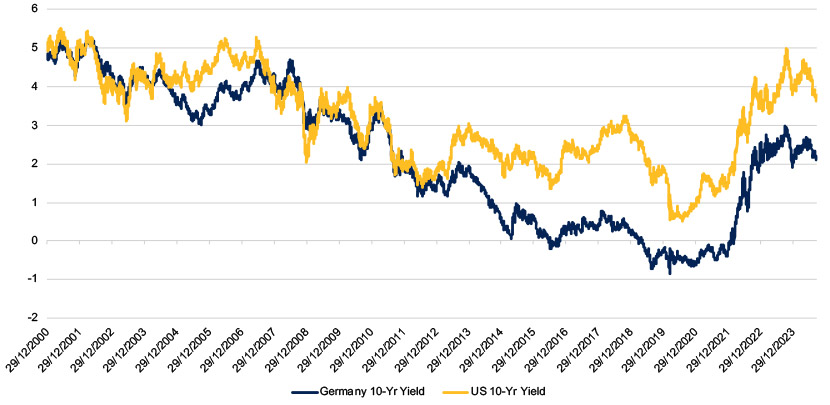

At the start of 2022, 10-year Euro government bonds were below zero, and 10-year US government bonds were at 1.5% but rates rose sharply through 2022 and into 2023. Both US and Euro bond yields have now returned to pre-2008 financial crisis levels, i.e. around 2% in the Eurozone and 4% in the US, presenting an entry point for investors that is more attractive than almost any other over the last decade.

Figure 1: Government bond yields have returned to pre-financial crisis levels

Source: Bloomberg

At the start of 2024, market consensus forecast a significant number of interest rate cuts over the following twelve months on both sides of the Atlantic, this pace of reductions would normally only be seen if these economies were entering a severe recession. This isn’t the scenario that has played out, and core rates rose until June having a negative impact on government bond prices, however, total returns over this period were supported by the coupon income and also, in the case of IG credit, tightening credit spreads as the economic backdrop began to look less worrying. As concerns about ‘sticky’ inflation subsided government bond yields have returned to levels close to where they started the year.

Both the European Central Bank (ECB) and the US Federal Reserve (Fed) have now started to cut rates and market pricing suggests that investors are anticipating further aggressive cuts in overnight rates. Indeed, the yield curve has now ‘uninverted’ i.e. 10-year bonds now yield more than 2-year notes indicating that the returns expected from cash deposits are expected to drop sharply over the coming twenty-four months. This creates a driver for investors to extend duration and take advantage of the higher yields available on longer term bonds.

We believe many investors are currently cautiously positioned in their asset allocation, with a large proportion of their portfolios in money market funds (MMFs), with some reports estimating USD$9 trillion1 is presently allocated to MMFs globally.

In the current investment environment, this makes sense in terms of the income profile of these investment vehicles, which is between roughly 2.5% and 4.5% dependent on the MMF currency of choice. However, if the monetary policy and inflation backdrop shifts as anticipated in the next twelve months, we would expect the income on these investment vehicles to drop significantly lower, presenting a far less attractive investment for investors.

For fixed income, the nature of bonds means that investors are “paid to wait” by virtue of the ongoing coupon stream. Over the last 12 months even though core rates have fluctuated, we have seen some IG strategies generate total returns of over 10%, with investors benefitting from coupon payments and alpha generation, far exceeding returns from cash holdings.

Credit spreads widen when markets appear strained and there are heightened default concerns, in certain asset classes. However, recent economic data and the subsequent movement in bond yields and equity markets suggest that the global economy is not entering a recession.

We research and analyse many companies who have IG credit ratings, and the vast majority are painting a healthy picture when it comes to their current business activities. The broader market conversation has moved on from a soft or hard landing to no landing at all; and this scenario can result in tightening credit spreads that can benefit investors in IG bonds.

By taking an active approach, it allows investors to gain exposure to the bonds of companies that should benefit from the current economic environment. It also allows greater flexibility to potentially avoid those companies that could have their business models challenged by the higher interest rate environment that has occurred over the last three years. In contrast, if investors take a passive approach, by investing in a benchmark-tracking fund, they will not benefit from this analysis that attempts to sift the winners from the losers and thus their investments could underperform an actively managed fund.

In the current backdrop, investors would do well to consider gaining an exposure to actively managed IG fixed income funds.

1 Bloomberg, September 2024

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2025 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.