Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Where we stand: by the ECB’s latest estimation, core inflation will be on track to meet the 2% target in 2026. Germany’s latest CPI reading – 2.0% for June – provided further assurance that inflation may be under control.

Reality check: focus is shifting to broader challenges like geopolitical uncertainty, de-globalisation and AI – as highlighted by the ECB’s latest strategy update.

Why it matters: these discussions will influence the Eurozone’s economic stability and subsequently the ECB’s reaction function over the long run.

The bottom line: tariffs, trade and fiscal will dominate the conversation over the next six to 18 months, but to navigate European macro, investors must also be attuned to structural changes occurring behind the scenes.

Big picture: Germany’s budget framework aims to boost core defence spending to 3.5% of GDP by 2029, increasing annual defence expenditure from €95 billion in 2025 to €162 billion in 2029.

Reality check: with a debt ratio of 63% of GDP, Germany has room to finance these initiatives.

By the numbers: the finance agency plans to raise €118.5 billion in Q3, €19 billion (0.45% of GDP) more than initially planned. Over the legislative period, the finance ministry expects to borrow ~€850 billion, including funds for military and infrastructure projects.

What’s next: long-end bund yields are likely to adjust as markets absorb the increased issuance.

The bottom line: Germany’s fiscal push marks a transformative shift, signalling the end of bund scarcity.

Source: Bloomberg, as at 2024.

* Compared with plan published in December.

Where we stand: the NOK strengthened 3% against the euro between mid-April and mid-June. But Norges Bank’s surprise move could pave the way for currency weakness over the summer.

Zoom out: if oil prices remain steady and the market anticipates a full easing cycle – alongside potential declines in rents – key protective factors for the NOK could erode.

What’s next: domestic liquidity flows are expected to dry up in the coming weeks, leaving the NOK vulnerable to algorithmic flows, impacting both FX and rates.

To the contrary: Norges Bank may reconsider its approach if the NOK weakens significantly, the jobs market improves, or if housing prices surge in response to easing measures.

Source: Norges Bank, as at June 2025.

Flashback: from 2018 to 2022, Italy’s bond spreads were a key source of market anxiety, driven by political and economic instability.

Reality check: politics have been a game-changer. Domestically, Prime Minister Meloni has brought stability, while internationally, her rising stature – especially with the US – has enhanced Italy’s credibility.

Between the lines: international investors diversifying away from US fixed income are favouring BTPs over Spanish or French bonds, citing Italy’s relative political stability and attractive valuations.

What’s next: if Italy’s stability persists, BTPs could potentially trade on par with French OATs, further strengthening the convergence narrative.

The bottom line: Italy’s bond market is benefiting from political stability and investor diversification, pushing spreads to (local) historic lows.

Source: Bloomberg, as at June 2025.

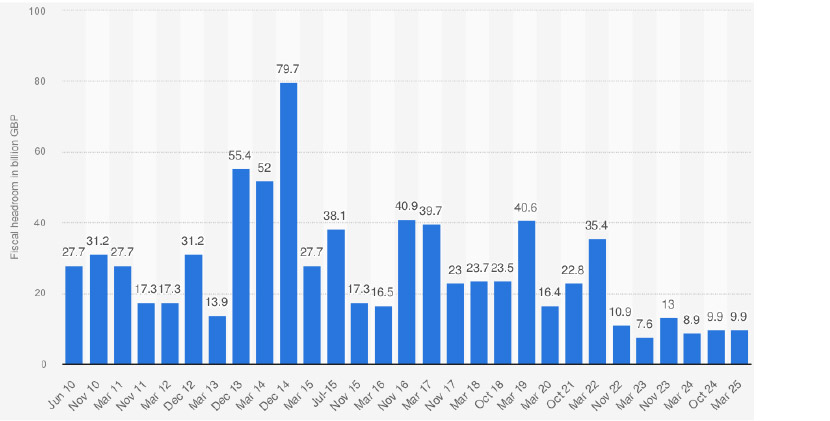

Context: anchoring long-end gilt yields requires structural inflation moderation and credible fiscal consolidation, both of which remain uncertain.

By the numbers: inflation shows signs of easing, with PMIs and CBI selling prices softening, though food prices remain elevated at over 4%.

Reality check: fiscal consolidation is in question as political pressure mounts on the reversal of previously announced spending cuts. Uncertainty lingers over defence spending and productivity, adding to the fiscal credibility challenge.

Investment implications: long-end gilts offer selective opportunities, but the risk/reward continues to favour fading any rallies, as fiscal and inflation uncertainties keep risks elevated and unresolved.

Source: Statista, as at March 2025.

All data sourced from Bloomberg, as at June 2025, unless otherwise stated.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.