Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways

The US would have to achieve an average 6.9% nominal GDP growth annually over the ten-year budget horizon in order to stabilise its debt-to-GDP ratio, while running the primary deficits set in Trump’s One Big Beautiful Bill Act (OBBBA). Growth at that level hasn’t been consistently achieved in the US over the last forty years – and when there has been a period of nominal growth at that level it has been followed by a sharp slowdown in subsequent years (Chart 1). That sets a fairly high bar for growth to stabilise debt at current levels, let alone outperform to begin ‘growing out’ of the government’s accumulated debt stock.

Source: Bloomberg, as at July 2025.

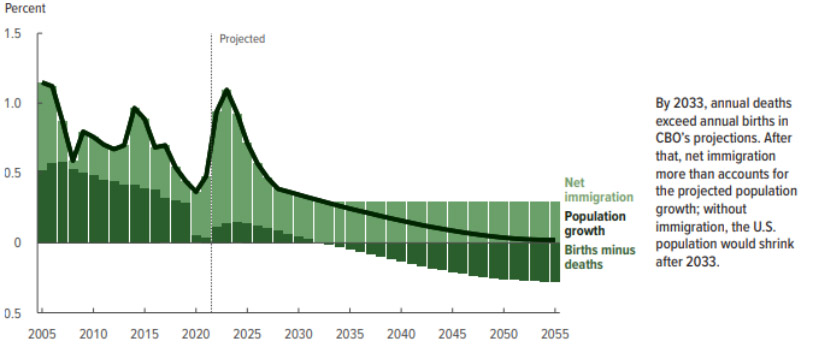

Population growth is on the decline in the US. The Congressional Budget Office’s (CBO) Demographic Outlook for 2025 projects the natural growth rate of the population to turn negative by 2033 (i.e. annual deaths in excess of annual births) (Chart 2), at which point the US population would begin to shrink without net immigration growth. That is a significant structural counter-weight to any future gains to potential GDP growth in the US – especially in the context of Trump’s aggressive anti-immigration policies.

Source: The Demographic Outlook (2025-2055).

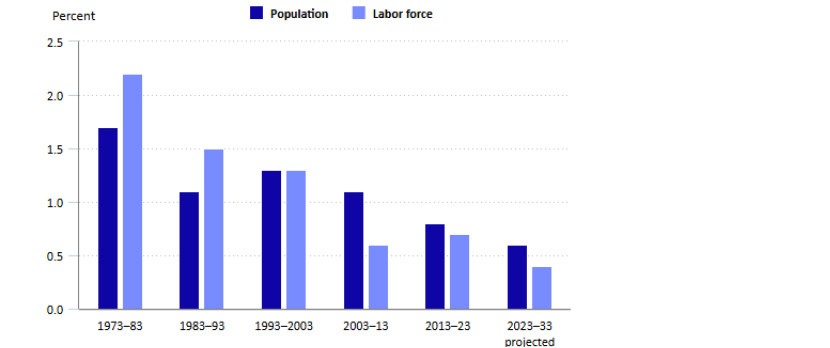

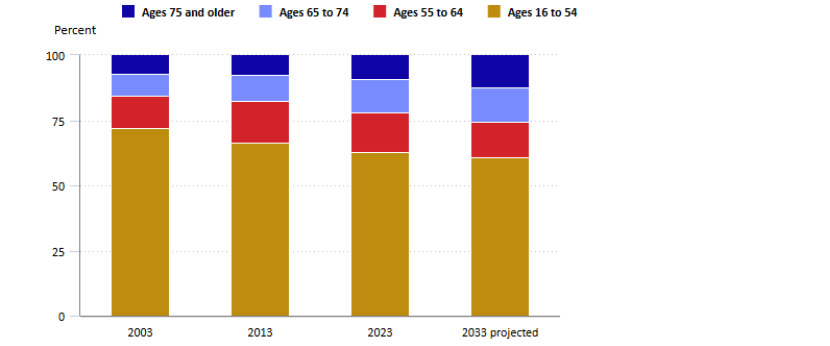

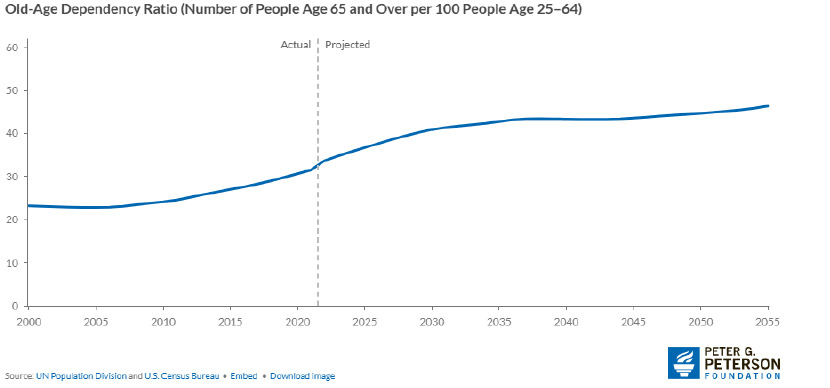

Growth of the labour force is set to slow even more than population growth over the coming decade as baby boomers shift into retirement (Charts 3 and 4). The structural ageing of the population implies a smaller potential revenue base (tax receipts) and greater required expenditure (entitlement programs). In other words, strong economic growth does not necessarily reduce the deficit one-for-one as the growth of the largest cost centre for the government will structurally outpace its revenue base. Indeed, the dependency ratio – the number of retirement age people per 100 working age people – is set to rise from 35.8 in 2024 to 42.0 in 2032, the same year Social Security is to reach insolvency (Chart 5).

Source: US Bureau of Labor Statistics - Monthly Labor Review.

Source: US Bureau of Labor Statistics - Monthly Labor Review.

Source: U.S. Population Growth Is Slowing Down — Here’s What That Means for the Federal Budget.

Trump’s OBBBA targets fiscal deficits of 6.5-7.0% GDP annually over the next ten years under an assumption for stellar growth exceeding trend annually over the period. But what happens if growth softens?

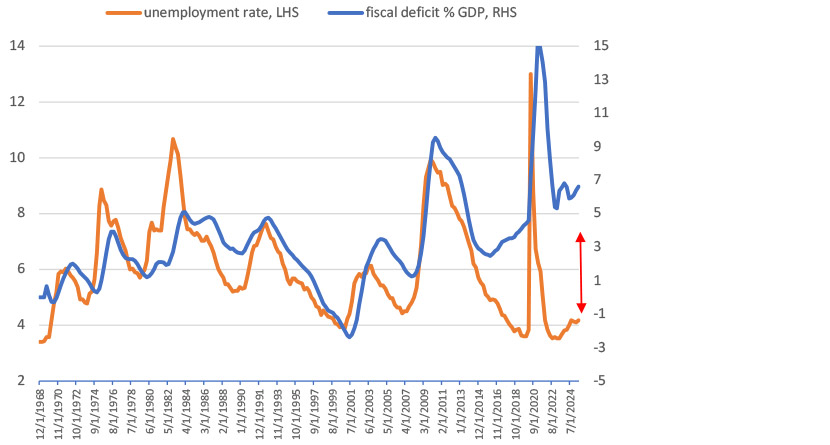

Over the last 40 years, automatic stabilisers have averaged -0.8 percentage points of potential GDP in years where GDP growth has underperformed, according to CBO data. That would already push the primary deficit out towards 4% GDP without any changes made to the budget or additional spending measures. This is the real danger: the degree of pro-cyclicality of the US fiscal position. Running a fiscal deficit near 7% GDP when the economy is strong and unemployment is low implies that any economic downturn will blow out the budget, and policy space to respond will be constrained (Chart 6). There is no margin of error left for fiscal policy to step in to help stimulate the economy in any case of weakness.

The US fiscal position is indeed exposed to economic growth performance, however risk is asymmetric and heavily skewed to the downside. While above trend growth has already been baked into the budget figures and therefore results in a less material fiscal outperformance versus targets, any economic underperformance would have severe implications on fiscal ratios and the trajectory of US debt dynamics.

While there is certainly an argument to be made for potential gains from a productivity-enhancing AI boom and deregulation efforts in the US, this has arguably already fed into the growth assumptions behind the budget.

At this point, the best thing Trump can do for fiscal policy is avoid a TACO on tariffs and ensure those additional revenues are large enough to have a meaningful impact. As it stands, if we annualise tariff revenues accrued in the month of June it would add USD245 billion, or around 1% of GDP, in additional revenues towards the budget’s bottom line. Although I’ve accounted for this revenue boost in the fiscal estimates, any ramp up in tariffs from here would continue to benefit the fiscal outlook.

Source: Bloomberg, as at July 2025.

The market has seemingly shrugged off the fiscal risks imbued in the passage of Trump’s OBBBA – with many arguing the US can easily grow out of its fiscal dilemma. I disagree. The growth risk underlying US debt sustainability is markedly asymmetric and skewed to the downside. This implies yield curve steepening pressures will persist, and any indication of softer growth should see a sharp acceleration in steepening momentum. We continue to like 2s30s curve steepeners and look for the curve to approach levels closer to 200bps.

All data is Bloomberg, unless otherwise stated.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2025 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.