Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways

Tariff uncertainty collided with post-election optimism earlier this year. De-regulatory supply-side policies have a deflationary bias considered positive for corporate profits. Tariffs, on the other hand, have to be paid for, pushing up prices and disrupting supply chains. Fears of recession increased, creating ‘push’ factors for capital to leave the U.S.. This is in contrast to Europe where security fears encouraged governments to prioritise rearmament spending at the same time as interest rates continued to be cut.

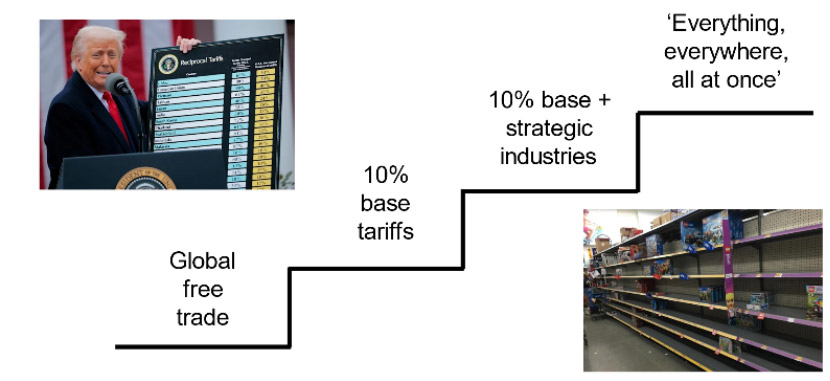

Investors and companies still don’t have the tariff policy certainty they crave. Different voices argue for different outcomes, creating a ‘stairway to liberation’ of compounding policy actions.

The tariff ‘stairway to liberation’

The first step, a 10% tariff on all imports, would be frustrating for companies, investors and consumers. But it would likely not force companies to rapidly change supply chains and would raise significant revenue for government coffers.

Some argue it doesn’t go far enough. The next step builds on the first by adding in tariffs on strategic industries, like rare earths, semiconductors and pharmaceuticals to encourage domestic re-shoring and support U.S. economic security. This is a more interventionist approach but if limited to specific business models, it is one that the market should be able to price effectively.

The final step is essentially the full ‘Rose Garden’ treatment with reciprocal tariffs based upon existing trade deficits, in particular with China, with the goal of reindustrialisation. This last step was quickly priced into equity markets after the ‘Rose Garden’ announcement elevated the risk of recession.

The 90-day moratorium on new tariffs came as a significant relief to equity markets. The implicit signal was that the risk of ‘everything, everywhere, all at once’ is significantly reduced. It was a well-timed intervention. Orders for Halloween and Christmas retail inventory need to be placed around now if product is to arrive in time, with delays risking empty shelves at Walmart. President Trump doesn’t want to be the President who cancelled Christmas.

Market consensus has moved back down the stairway and now appears to be somewhere between steps 1 and 2.

This is a better outcome than feared in early April that has helped equity markets recover their early Spring losses. The implied risk of recession has fallen from above 50% to somewhere in the 30s% (compared to a notional probability of 20-25% in any given year).

There are a few things we don’t yet know. Firstly, will there be a long-lasting trade agreement between the U.S. and China? Scott Bessent, Treasury Secretary, has said that neither country wants to ‘decouple’ from the other, which if true may indicate a settlement is possible. But this is in conflict with the re-industrialisation objective that requires a degree of inevitable decoupling, so who is right?

Secondly, even if outline deals are agreed in the next 60 days, will they be strong enough to give companies the confidence to invest? Or will delays cause an activity air-pocket and push the U.S. into recession anyway?

Finally, might we be looking at stagflation (lower growth and inflation above 2% for longer) or a ‘Goldilocks’ economy (3% growth and inflation 2-3%) in future? The market is looking for clues, hence the focus on ‘soft’ (current survey data) and ‘hard’ (backward-looking official data) economic indicators. Results so far are somewhat ambiguous.

So far, companies’ reported Q1 earnings have been better than feared. But Q1 was arguably always a ‘pass’ given that tariffs weren’t fully announced until the beginning of Q2. Earnings estimates have held up surprisingly well, despite ongoing policy uncertainty, but profit estimates often fade through the second half. Given valuations have recovered, this is leading many investors to ask ‘now what?’

The market rotation from the U.S. to Europe feels as though it has stalled. Tech stocks and ‘retail favourites’, such as Tesla, have been doing better lately. It is probably dangerous to be too dismissive of the U.S.. The natural advantages the country has in terms of its innovation-friendly eco-system, expanding demographics and high labour productivity all still mean that anyone looking to allocate their marginal dollar will have to consider the U.S. economy. The popularity of passive investment solutions in the U.S. also continues to act as a magnet for global capital as firms look to list in a market where passive means there is a surfeit of wealthy, value-agnostic investors.

In contrast, Europe has potential, but we have yet to see sustained commitment to the type of economic reforms and liberalisation that were set out in Mario Draghi’s 2024 report. A re-ordering of spending priorities in favour of defence is making new funds available which, together with falling interest rates, is supporting hopes of an improved environment to corporate profitability. However, this is a simple transient multiplier effect to growth – sustained economic growth probably requires supply-side reforms, the appetite for which remains unclear. A useful test-case for investors to monitor is cross-border banking consolidation, such as UniCredit’s approach to Commerzbank.

Our approach is a focus on company fundamentals, especially quality companies run by strong management teams, as they will be more resilient and will likely be able to take advantage of industry change better than weaker competitors. It is also important not to forget risk. Recent market volatility has highlighted the dangers of taking a strong market (beta) or country (U.S. versus Europe) view. Better to diversify such macro risks, monitor positive momentum exposure by not letting position sizes drift too far and let the company holdings do the talking.

Source: Bloomberg or publicly available data, as at May 2025.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2026 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.