Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

“In Europe, the Green Deal Industrial Plan, introduced in February 2023, sets out a path to enhancing the competitiveness of the continent’s nascent net zero industry.”

Last year was one of progress in the development of clean energy but also frustration, as political discourse continued to detract from the global aim of reducing reliance on carbon-intensive energy sources.

The summer of 2023 was the hottest on record, with extreme weather events linked to climate change causing major damage and loss of life around the world. The COP 28 conference in Dubai was overshadowed by political debates that did little to support a common solution to climate change.

At the same time, supply chain issues and the rising costs of raw materials have impacted the development of new renewable energy projects. Inflation has prompted calls for a rethink on how offshore wind and similar developments are priced.

However, there were also many positive developments. Throughout the year, we saw significant investment from governments into clean energy infrastructure and technology. The Inflation Reduction Act in the US allocates approximately $400 billion1 in direct investments into energy security projects, including energy- related innovation, with the goal of substantially lowering the nation’s carbon emissions - committing the US to reduce its carbon emissions by 40 percent by 2030.

In Europe, the Green Deal Industrial Plan, introduced in February 2023, sets out a path to enhancing the competitiveness of the continent’s nascent net zero industry. Other European initiatives such as the Strategic Technologies for Europe Platform are also supporting companies in these areas.

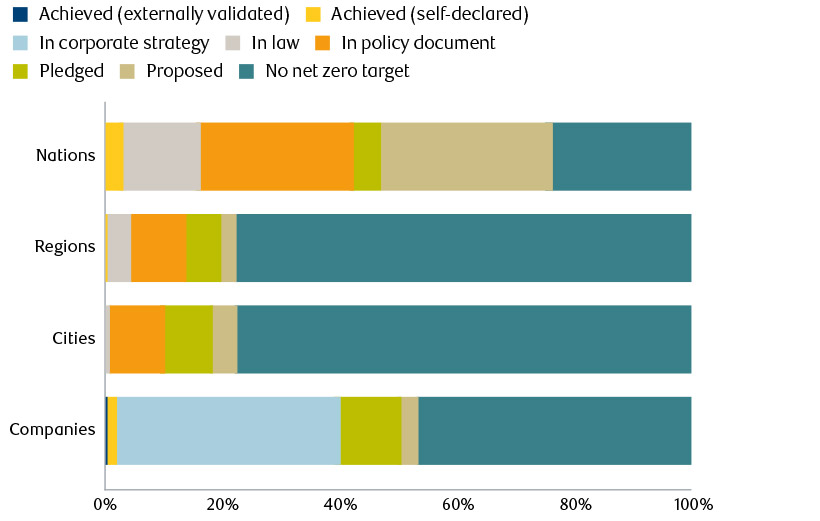

Chart 1: How are nations doing on net zero targets compared with companies?

Source: Data explorer, zerotracker.net.

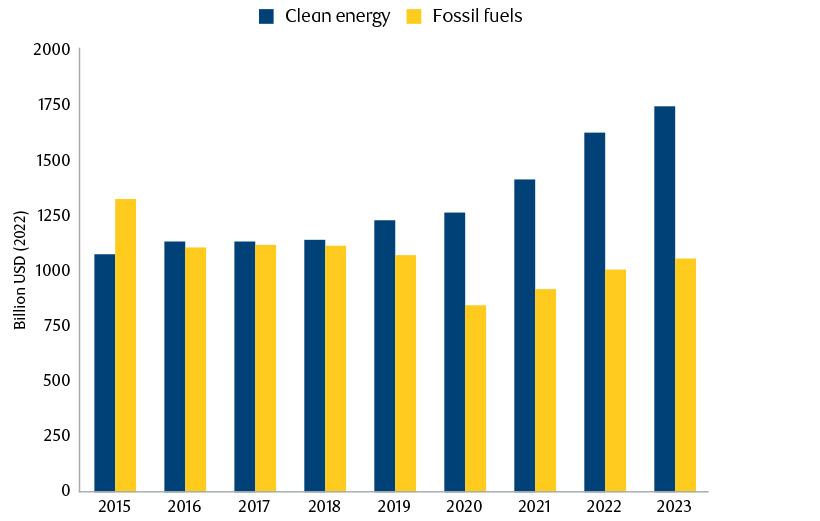

Chart 2: Global energy investment in clean energy and in fossil fuels

Source: World energy investment in 2023, iea.org.

Most major economies have now set net zero targets, and many of these have passed into law, including Canada, the U.S., U.K. and the E.U.

While some of the political rhetoric around the COP 28 conference was disappointing, it is important to highlight that progress was made on some key climate issues.

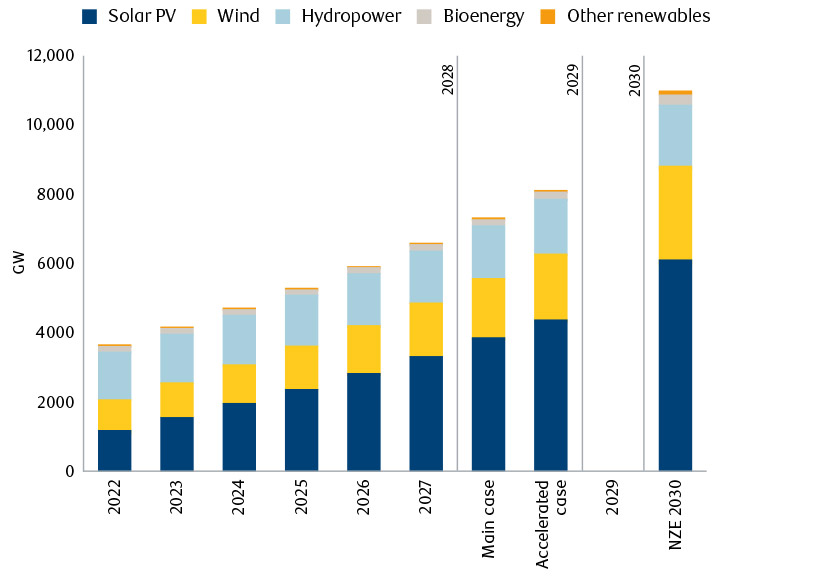

There was agreement on the first ‘Global Stocktake’ on progress towards limiting the global average temperature rise to 1.5°C above pre-industrial levels, with a call for countries to accelerate their move away from fossil fuels. Led by the EU, there was an internationally agreed pledge to triple renewable energy capacity to “at least 11,000 gigawatts by 2030, accelerate energy efficiency and prioritise this at government and policy levels2.

The road to a clean energy economy was never going to be easy. There remain significant challenges ahead, but an even more promising multi-trillion-dollar, multi-year investment opportunity.

As with most other sectors, the Covid-19 pandemic hit the energy industry hard as societies were forced to quickly adjust to social distancing requirements and remote working.

However, the period also seemed to trigger an uptick in investment into companies, projects and technology supporting the energy transition. Global clean energy investment rose from $1.23 trillion in 2019 to $1.26 trillion in 2020, and has increased each year since to an estimated $1.74 trillion in 20233.

China has also emerged as a major investor in clean energy. In 2022, it accounted for almost half of global spending on clean energy, according to BloombergNEF4, spending $546 billion as the global total surpassed $1 trillion for the first time5.

The biggest impact on the energy sector, however, stemmed from the Russian invasion of the Ukraine in early 2022. The ongoing hostilities and sanctions placed on Russia by the European Union have prompted a major rethink of energy security issues, given the bloc’s reliance on Russian oil and gas.

The price of oil spiked in the first half of 2022, increasing by more than 60 percent to a peak in June. Natural gas, meanwhile, almost tripled in price between January and August 20226. These price increases fuelled a cost-of- living crisis across many economies that were dependent on Russian fossil fuels. Prices have since fallen back below where they were two years ago, which has helped reduce inflationary pressures.

After a period of strong investment returns from the renewable energy sector, 2022 saw significant headwinds emerge. Supply chain issues and spiralling costs for steel, cement and other materials meant construction costs suddenly increased significantly, putting pressure on developers, and making pricing less attractive

for investors.

In addition, several companies in the renewable energy sector did not factor in indexation into their supply contracts. This meant that while supply chain and material costs increased significantly since 2020, suppliers’ were unable to offset the impact on their margins by adjusting their price to the consumer.

Several major projects were cancelled in 2023 amid these pressures, including a planned allocation of up to 5 gigawatts of contracts of offshore wind capacity in the UK. The UK government set the price cap too low and failed to reflect the rising costs of materials in their pricing7. It will have to learn lessons quickly if it is to meet its target of 50 gigawatts of offshore wind capacity by 2030.

These and other issues have meant that renewable energy investments largely underperformed the wider market in 2023. However, we believe the sector has been oversold and is due for an improvement in performance. Production and supply should be improved by the reopening of China’s manufacturing sector after lengthy pandemic-induced shutdowns, with the country expected to add 62 gigawatts of capacity in wind power alone in 20248.

At COP28, 118 countries adopted a pledge to triple global renewable energy capacity to at least 11,000GW by 2030. Wind and solar energy are well established as the two primary renewable energy sources, despite the headwinds outlined above, capacity is still expected to increase in 2024. A total of 340 gigawatts of new renewable capacity was added in 2022, according to the International Energy Agency, with solar alone adding 220 gigawatts worldwide. An estimated 510 gigawatts of new capacity is expected to have been added in 2023, and the latest IEA report shows that under existing policies and market conditions, global renewable power capacity is now expected to grow to 7,300GW over the 2023-2028 period9.

One of the biggest areas in which development is needed is battery storage. Fortunately, there has been a significant increase in investment, particularly in the US. Capacity more than tripled between 2020 and 2022 to reach 8.8 gigawatts10.

We are still at the very early stages of battery technology however, and more investment into research and development of this technology is required. Grid-scale batteries can be expensive, particularly where new connections to the grid are required, but improving battery storage would reduce the need for expensive new transmission lines.

Chart 3: Cumulative renewable electricity capacity in the main and accelerated cases and net zero scenario

Source: Executive summary 2003, iea.org.

One of the biggest challenges for battery technology development is China’s dominance of the markets for many of the raw materials involved. China provides two thirds of the world’s processed lithium and 95 percent of manganese sulphate, 93 percent of finished anodes and 78 percent of cathodes11.

This dominance comes amid increased trade issues between Europe, the US and China. While the new policies in western markets may go some way to localising development in this area, this may take many years to materialise.

There now appears to be more acceptance of nuclear as a source of low-carbon energy. It is a divisive issue, but it is difficult to envisage a path to net zero by 2050 without it. According to the International Energy Agency, nuclear capacity needs to triple by 2030 in order to meet global decarbonisation goals12.

At COP 28, 22 countries backed a pledge to advance this aim to triple nuclear capacity by 2050, including the US, France, the UK, and the United Arab Emirates, while South Africa is also considering nuclear energy.

This marks an important change in attitudes towards nuclear energy. Some countries began to turn their back on the technology in the wake of the 2011 Fukushima disaster, but the safety record is far better than public perception suggests. New reactors are being developed by companies such as EDF in Europe that are more economical than older reactors.

That said, there is still a significant issue around the afterlife of nuclear waste and its safe disposal. As a result, currently, BlueBay Investment platform does not invest materially into nuclear energy.

Hydrogen is widely considered to be the most promising long-term replacement fuel as the world seeks to phase out oil and gas. It is an abundant, non-toxic energy vector, more efficient than many other renewables, and – in its greenest form – carbon-free.

However, it remains expensive to produce, store and transport. This means that most current use cases are focused on localised storage for heavy industry, or for long distance transport or aviation.

The Inflation Reduction Act in the US includes major subsidies for the development of hydrogen and fuel cell technology designed to support domestic renewable energy production. Meanwhile, Europe is emerging as a potential leader in the hydrogen space. Of an estimated $320 billion invested directly in hydrogen projects as of May 2023, $117 billion (36.6 percent) has been invested in Europe, according to McKinsey13.

Expanding renewable energy production and investing in new power sources is only part of the story, however. Ensuring that this clean energy gets to where it is needed requires a significant amount of investment into transmission and distribution through upgrading energy grids.

Energy sources such as wind have peaks and troughs of power production, which requires storage or efficient transmission – preferably both – to reliably meet demand. However, as outlined earlier in this paper, storage technology is still in its infancy. This means it is essential to invest in improving the capacity and resilience of energy transmission networks to ensure the clean power generated does not go to waste.

A reliable and robust transmission and distribution network is also essential to Europe’s energy security goals. Renewable energy companies have warned that the current state of the continent’s energy grid requires urgent investment to meet the surge in demand for clean energy and support the growing electric vehicle sector14.

The Russia-Ukraine war and its impact on the energy supply landscape in Europe has prompted the EU to accelerate plans to invest in its energy grid as well as renewable sources. This will require “a deep digital and sustainable transformation of our energy system”, according to the European Commission’s October 2022 Action Plan15. It has estimated that approximately €584 billion ($643 billion) would need to be invested in energy transmission by 2030 to meet its goals.

The US is facing similar issues. While renewable energy development has increased significantly in recent years, there remain problems with connecting these new sources to the country’s energy grid as much of it is regulated at a state level. More localised ‘islands’ generating their own energy is a solution under consideration in many places across the US16.

Grid investment is increasing – more than $300 billion is expected to have been spent in 202317 – but more is required to facilitate the new generation projects funded by the Inflation Reduction Act. This means that there is a significant potential investment opportunity in the distribution and transmission space to support the development of modern, robust infrastructure.

According to the International Energy Agency18, global spending on energy grids needs to rise by as much as 50 percent by 2030 (compared to 2020 levels) if net zero pledges are to be achieved. This presents another significant investment opportunity for investors with sufficient knowledge and expertise.

It is clear that there is still a significant investment gap across the board in clean energy. More spending is needed to develop cleaner forms of hydrogen, to expand and improve capacity and efficiency, and to overhaul transmission systems to get this clean power to where it is needed.

Trillions of dollars are being spent each year on clean energy technologies, but there is a huge amount of capacity for additional investment. However, to make such investments attractive requires robust and cohesive policies that protect investors and other stakeholders from the issues that have curbed investment in 2023. As a society, we cannot afford to repeat the pricing mistakes that have already proven costly over the past year.

Collaboration will be key to future success. For example, some of Europe’s leading fossil fuel companies are making significant inroads into developing renewable energy – most notably, BP has been promoting its “beyond petroleum” ambitions. But for this to succeed, investors need to hold such companies to account to ensure they meet their promises. Equally, collaboration between investors and companies is needed to address the transition to a net zero economy in order to mitigate climate-related risks.

It has been a difficult period for clean energy investors, but we firmly believe that the long-term investment prospects for the sector are strong. With sufficient cohesive policy support, the private sector can be the driver of success.

1 Think.ing.com Published: 17 August 2023.

2 European Commission, ‘Global Renewables and Energy Efficiency Pledge’, published 2 December 2023.

3 International Energy Agency, ‘World Energy Investment 2023 – Overview and key findings’, published May 2023.

4, 5 BloombergNEF, ‘Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time’, published 26 January 2023.

6 WTI crude oil and natural gas price data sourced from Bloomberg.

7 Reuters, ‘UK mulls revamp of offshore wind pricing after failed auction’, published 13 October 2023.

8 International Energy Agency, ‘Renewable Energy Market Update – June 2023’, published June 2023.

9 International Energy Agency, ‘Renewables 2023 January 2024’, published January 2024.

10 US Energy Information Administration, ‘Battery Storage in the United States: An Update on Market Trends’, published 24 July 2023.

11 Benchmark Mineral Intelligence, ‘Infographic: China’s lithium ion battery supply chain dominance’, published 3 October 2022.

12 International Energy Agency, ‘Nuclear Power’, updated 11 July 2023.

13 McKinsey, ‘What is hydrogen energy?’, published 27 September 2023.

14 Review Energy, ‘Europe’s wind and power groups make urgent call for more investment in power grids’, published 6 September 2023.

15 European Commission, ‘Digitalising the energy system – EU action plan’, published 18 October 2022.

16, 18 EY, ‘How transmission investment could unlock global growth in renewables’, published 12 October 2021.

17 S&P Global Market Intelligence, ‘Curtailment, congestion costs rise as transmission upgrades lag renewable growth’, published 2 November 2023.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2023 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Subscribe now to receive the latest investment and economic insights from our experts, sent straight to your inbox.