Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the International Monetary Fund (IMF) with the remaining classified as ‘emerging market and developing’.

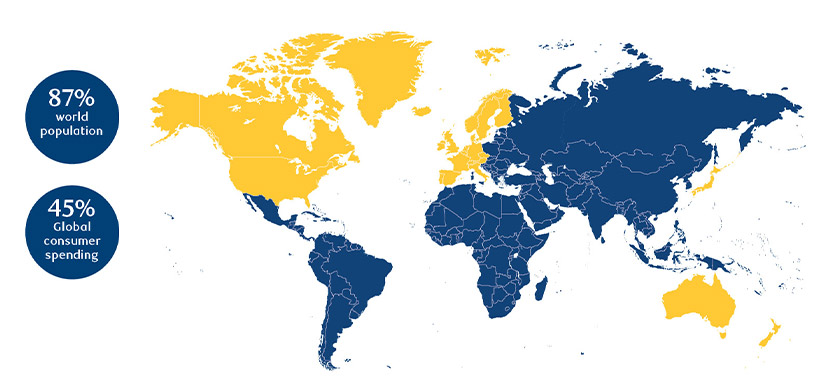

Combined, emerging market economies account for over 50% of global Gross Domestic Product (GDP), 45% of global consumer spending and roughly 87% of the world’s population2. The EM debt universe comprises four primary sub-classes: hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

Source: RBC GAM, as at December 2024.

Despite being the world’s largest pool of credit, at $29 trillion in size, EMD or emerging market debt remains one of the most misunderstood markets amongst investors, not only in terms of composition of the asset class but also the risk-reward profile of the underlying assets. Indeed, asset allocators and investors alike are often surprised to discover the breadth, versatility and return opportunities the asset class can offer their portfolios and, moreover, the fundamental and liquidity characteristics of various sub-asset classes.

In the note below, we provide an overview of EMD, summarizing the distinct sub-asset classes that offer differentiated risk-return characteristics that can potentially enhance portfolio outcomes.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Although there is no official definition, within capital markets the term ‘emerging markets’ is generally used to refer to countries with lower per capita income and limited integration within the global financial system.

While they have may have an established financial infrastructure, the institutional strengths and market characteristics of these emerging markets may not be on par with the efficiency, accounting standards or securities regulations of ‘developed’ nations.

Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the IMF with the remaining classified as ‘emerging market and developing’. These countries are widely dispersed across Latin America, Asia, Eastern Europe, the Middle East and Africa, and range in size from giants like China and India to much smaller countries such as Belize and Ivory Coast. Combined, emerging market economies account for over 50% of global GDP, 45% of global consumer spending and roughly 87% of the world’s population.

Source: Oxford Economics and the IMF, as at 30 September 2024

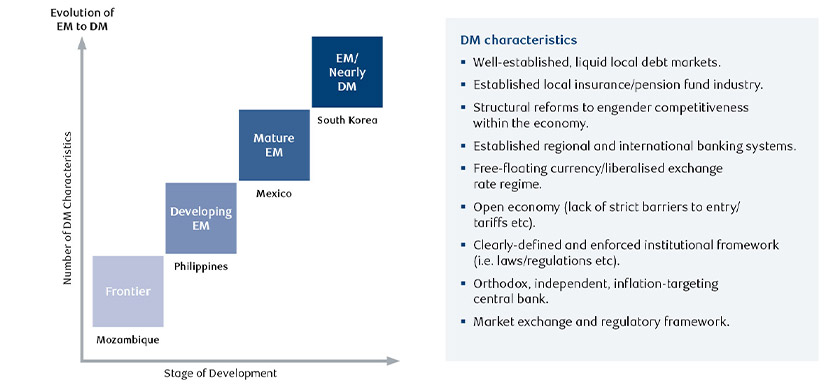

Market liquidity and governance factors have historically been a key factor in defining classification. Some countries such as South Korea are considered developed by the IMF but deemed as emerging by some market participants. Likewise, some EM countries, such as Brazil, China, and India rank amongst the world’s largest economies, but are considered by most as emerging economies. At the opposite end of the spectrum there are frontier markets (less developed economies) such as Mozambique, which are typically smaller and have less liquid capital markets.

Clearly these markets will not have progressed as far down the path as today’s developed markets (DM), and as such, debt from these economies will be subject to a higher level of risk premia than their developed counterparts, thus rewarding investors with a higher yield. Figure 3 shows the stages of development as emerging countries transition towards developed market status.

Source: BlueBay Asset Management

The size and sophistication of the investable universe of debt issued in emerging countries has increased substantially over the last 30 years. EM debt was once issued only sporadically and in US dollar denominations, but today far fewer EM governments require support from G-7 nations for their funding and are able to access the international capital markets directly. Moreover, because of strong internal growth, economic development and favourable macroeconomic factors, many EM sovereigns have also developed deeper domestic capital markets. This has, in many cases, translated into a significant shift to local currency debt issuance.

The EM debt universe comprises four primary sub-classes and accounts for nearly US$29 trillion3. This is a large heterogenous asset class with debt issued in both hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

The following compares the key characteristics of the four main sub-asset classes:

The EM hard currency sovereign sub-class is the oldest and most established going back to the Brady bond era in the early 1990s. The market has since evolved significantly, presenting a broad opportunity set for investors. Not surprisingly, it has the largest group of managers involved and is more familiar to many investors.

These bonds have a global investor base and tend to trade at a spread over US Treasuries and are therefore much more sensitive to US rates. Compared to local currency bonds, hard currency bonds also tend to have longer maturities and larger issuance sizes, making them easier to trade on the secondary market. The depth of the market and diverse set of participants, including local and foreign investors, translates into higher trade volumes and strong liquidity levels.

The hard currency EM corporate debt market is a diverse and very well-established asset class which has seen strong growth in the last decade, driven by robust investor demand, rapid long-term EM economic growth, and increasing integration into global capital markets. Despite being a majority investment grade (IG) rated asset class, EM corporate debt has offered higher yield over similarly rated DM corporates, a reflection of the higher risk premium investors typically require when investing in EM. However, investor perception of risk in emerging markets is changing as corporate governance and transparency continue to improve and macro policy across the EM universe has become more orthodox.

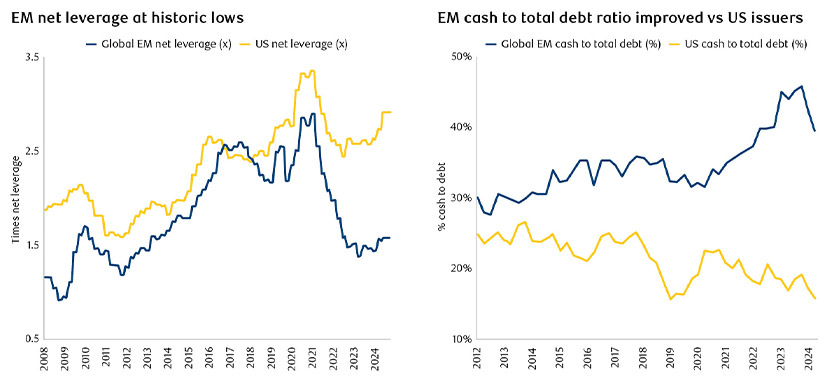

At a company level, fundamentals have seen considerable improvement over the last few years as EM corporates have consistently reported lower leverage and higher cash to total debt ratios than their US counterparts. Currently, the difference in net leverage and cash to debt ratio in EM vs DM (using US corporates as a proxy) stands above 10-year highs (Figure 4).

Source: Bank of America, Merrill Lynch, as at 31 December 2024.

The EM local currency market is a vast, rapidly growing universe. The range includes countries that are more mature, with a full scope of liquid cash and derivative instruments, to markets that are considered ‘frontier’, embarking on a long and difficult process of opening their capital accounts and deepening their local markets to attract foreign capital.

Opportunities for diversification are vast, with a multitude of sovereign and corporate issuers, inflation-linked and nominal debt, free floating to managed or pegged currencies. Debt denominated in local EM currencies typically have shorter duration and are more influenced by local inflation expectations and central bank policies. Investors in EM local currency debt tend to be domestic market participants and specialized EM funds.

Despite the breadth of the opportunity set, the most widely used index – the JPM GBI-EM Global Diversified Index Unhedged – reflects only a very specific subset of the universe, limited to the larger, more liquid markets. The price for limiting the benchmark to this subset, however, is that it has become a very concentrated and highly volatile point of reference for the market. Indeed, this detracts from the very specific diversification benefits which draw investors to this asset class in the first place.

The EM local currency corporate debt market, in its broadest form, covers over 80% of the global EM debt universe, with local capital markets in varying stages of development. This ranges from more mature EM countries, such as Brazil and Mexico, to markets that are considered frontier, such as Kazakhstan, and which can offer idiosyncratic opportunities. Local currency corporates typically offer higher yields when compared to local currency sovereigns due to the additional credit risk, and they are often less liquid with fragmented issuance across different countries and regulatory frameworks.

In addition, while governments actively seek foreign investment for local currency sovereign bonds, corporate debt tends to have greater restriction on foreign investor participation. These challenges combined have limited the level of foreign investor sponsorship of the local currency EM corporate sub-asset class, despite the overall higher credit ratings and lower duration risk.

1 JPMorgan, RBC BlueBay Asset Management, as at December 2024.

2 IMF, as at Q3 2024.

3 JPMorgan, as at 31 December 2024.

4 RBC Global Asset Management, as at 31 December 2024.

5 Quasi-sovereign: an entity that is 100% guaranteed by a sovereign or majority owned or controlled by a sovereign.

6 RBC Global Asset Management, as at 31 December 2024.

7, 8 RBC Global Asset Management, as at 31 December 2024.

Suscríbase ahora para recibir las últimas perspectivas económicas y de inversión de nuestros expertos directamente en su bandeja de correo.

Este documento es una comunicación de marketing y puede ser producido y emitido por las siguientes entidades: en el Espacio Económico Europeo (EEE), por BlueBay Funds Management Company S.A. (BBFM S.A.), sociedad regulada por la Commission de Surveillance du Secteur Financier (CSSF). En Alemania, Italia, España y los Países Bajos, BBFM S. A opera con un pasaporte de sucursal con arreglo a lo dispuesto en la Directiva sobre organismos de inversión colectiva en valores mobiliarios (2009/65/CE) y la Directiva relativa a los gestores de fondos de inversión alternativos (2011/61/UE). En el Reino Unido por RBC Global Asset Management (UK) Limited (RBC GAM UK), sociedad autorizada y regulada por la Financial Conduct Authority (FCA) del Reino Unido, registrada ante la Securities and Exchange Commission (SEC) de los Estados Unidos y miembro de la National Futures Association (NFA) autorizada por la Commodity Futures Trading Commission (CFTC) de los Estados Unidos. En Suiza, por BlueBay Asset Management AG, país en el que el Representante y Agente de pagos es BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich (Suiza). El lugar de ejecución es el domicilio social del Representante. Los órganos judiciales del domicilio social del representante suizo o el domicilio social o lugar de residencia del inversor tendrán la competencia para conocer las reclamaciones relacionadas con la oferta o publicidad de acciones en Suiza. El Folleto, los Documentos de datos fundamentales para el inversor (KIID), los documentos de datos fundamentales (KID) de los PRIIP (productos de inversión minorista vinculados y los productos de inversión basados en seguros), cuando proceda, la escritura de constitución y cualquier otro documento necesario, por ejemplo, los informes anuales y semestrales, pueden obtenerse de manera gratuita solicitándolos al Representante en Suiza. En Japón, por BlueBay Asset Management International Limited, sociedad registrada ante la Kanto Local Finance Bureau del Ministerio de Finanzas de Japón. En Asia, por RBC Global Asset Management (Asia) Limited, sociedad registrada ante la Comisión del Mercado de Valores y Futuros de Hong Kong. En Australia, RBC GAM UK se encuentra exenta del cumplimiento de la obligación de poseer una licencia de servicios financieros australiana en virtud de la Ley de sociedades (Corporations Act) para la prestación de servicios financieros, ya que está regulada por la FCA de acuerdo con la legislación del Reino Unido, que difiere de la australiana. En Canadá, por RBC Global Asset Management (incluido PH&N Institutional), sociedad regulada por cada una de las comisiones provinciales y territoriales del mercado de valores ante la que esté registrada. RBC GAM UK no se encuentra registrada en virtud de la legislación sobre valores negociables, sino que se acoge a la exención para operadores internacionales contemplada por la legislación provincial aplicable a esta materia, la cual permite a RBC GAM UK llevar a cabo determinadas actividades específicas como operador para los residentes canadienses que tengan la calificación de «cliente canadiense permitido» (Canadian permitted client), según la definición de dicho término en la legislación aplicable a valores negociables. En Estados Unidos, por RBC Global Asset Management (U.S.) Inc. («RBC GAM-US»), asesor de inversiones registrado ante la SEC. Las entidades señaladas anteriormente se denominan colectivamente «RBC BlueBay» en el presente documento. No debe interpretarse que las afiliaciones y los registros mencionados comportan un apoyo a RBC BlueBay ni tampoco su aprobación por parte de las respectivas autoridades competentes en materia de licencias o registros. No todos los productos, servicios e inversiones que se describen en el presente documento están disponibles en todas las jurisdicciones, y algunos de ellos solo lo están de forma limitada, debido a las exigencias jurídicas y normativas locales.

El documento va dirigido exclusivamente a «Clientes Profesionales» y «Contrapartes Elegibles» (como se define en la Directiva relativa a los mercados de instrumentos financieros [«MiFID»]); o en Suiza a los «Inversores Cualificados», tal y como se definen en el Artículo 10 de la Ley suiza de organismos de inversión colectiva y su ordenanza de aplicación; o en Estados Unidos a «Inversores Acreditados» (según la definición de la Ley de valores negociables [Securities Act] de 1933) o «Compradores Cualificados» (conforme a la definición de la Ley de sociedades de inversión [Investment Company Act] de 1940), según sea aplicable, y ninguna otra categoría de cliente debería basarse en él.

Salvo indicación en contrario, todos los datos proceden de RBC BlueBay. Según el leal saber y entender de RBC BlueBay, este documento es veraz y correcto en la fecha de su emisión. RBC BlueBay no otorga ninguna garantía ni realiza ninguna manifestación ni expresa ni tácita con respecto a la información incluida en este documento y excluye expresamente en este acto toda garantía de exactitud, integridad o adecuación a un fin concreto. Las opiniones y estimaciones están basadas en nuestro propio criterio y podrían cambiar sin previo aviso. RBC BlueBay no proporciona asesoramiento de inversión ni de ningún otro tipo. El contenido del presente documento no constituye asesoramiento alguno ni debe interpretarse como tal. El presente documento no constituye una oferta para vender, ni una solicitud de una oferta para comprar, ningún título o producto de inversión en ninguna jurisdicción. Esta información se ofrece únicamente a efectos informativos.

Queda prohibida toda reproducción, redistribución o transmisión directa o indirecta de este documento a cualquier otra persona, o su publicación, total o parcial, para cualquier fin y de cualquier modo, sin el previo consentimiento por escrito de RBC BlueBay. Copyright 2023 © RBC BlueBay. RBC Global Asset Management (RBC GAM) es la división de gestión de activos de Royal Bank of Canada (RBC) que incluye a RBC Global Asset Management (U.S.) Inc. (RBC GAMUS), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited y RBC Global Asset Management (Asia) Limited, entidades mercantiles independientes, pero vinculadas. ® / Marca(s) registrada(s) de Royal Bank of Canada y BlueBay Asset Management (Services) Ltd. Utilizada(s) con autorización. BlueBay Funds Management Company S.A., con domicilio social en 4, Boulevard Royal L-2449 Luxemburgo, sociedad registrada en Luxemburgo con el número B88445. RBC Global Asset Management (UK) Limited, con domicilio social 100 Bishopsgate, London EC2N 4AA, sociedad registrada en Inglaterra y Gales con el número 03647343. Todos los derechos reservados

Suscríbase ahora para recibir las últimas perspectivas económicas y de inversión de nuestros expertos directamente en su bandeja de correo.