Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the International Monetary Fund (IMF) with the remaining classified as ‘emerging market and developing’.

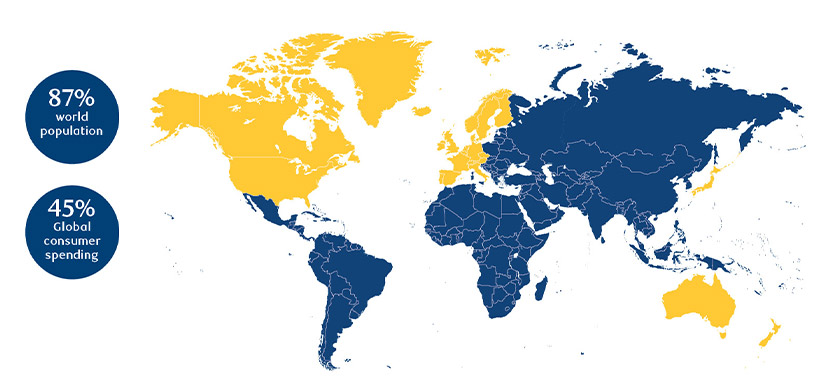

Combined, emerging market economies account for over 50% of global Gross Domestic Product (GDP), 45% of global consumer spending and roughly 87% of the world’s population2. The EM debt universe comprises four primary sub-classes: hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

Source: RBC GAM, as at December 2024.

Despite being the world’s largest pool of credit, at $29 trillion in size, EMD or emerging market debt remains one of the most misunderstood markets amongst investors, not only in terms of composition of the asset class but also the risk-reward profile of the underlying assets. Indeed, asset allocators and investors alike are often surprised to discover the breadth, versatility and return opportunities the asset class can offer their portfolios and, moreover, the fundamental and liquidity characteristics of various sub-asset classes.

In the note below, we provide an overview of EMD, summarizing the distinct sub-asset classes that offer differentiated risk-return characteristics that can potentially enhance portfolio outcomes.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Although there is no official definition, within capital markets the term ‘emerging markets’ is generally used to refer to countries with lower per capita income and limited integration within the global financial system.

While they have may have an established financial infrastructure, the institutional strengths and market characteristics of these emerging markets may not be on par with the efficiency, accounting standards or securities regulations of ‘developed’ nations.

Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the IMF with the remaining classified as ‘emerging market and developing’. These countries are widely dispersed across Latin America, Asia, Eastern Europe, the Middle East and Africa, and range in size from giants like China and India to much smaller countries such as Belize and Ivory Coast. Combined, emerging market economies account for over 50% of global GDP, 45% of global consumer spending and roughly 87% of the world’s population.

Source: Oxford Economics and the IMF, as at 30 September 2024

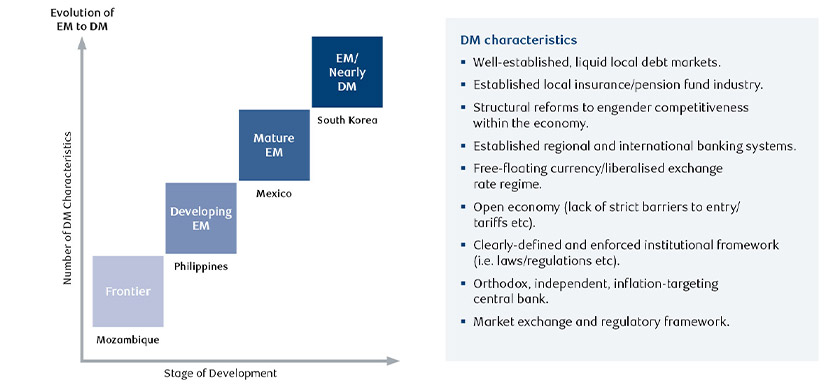

Market liquidity and governance factors have historically been a key factor in defining classification. Some countries such as South Korea are considered developed by the IMF but deemed as emerging by some market participants. Likewise, some EM countries, such as Brazil, China, and India rank amongst the world’s largest economies, but are considered by most as emerging economies. At the opposite end of the spectrum there are frontier markets (less developed economies) such as Mozambique, which are typically smaller and have less liquid capital markets.

Clearly these markets will not have progressed as far down the path as today’s developed markets (DM), and as such, debt from these economies will be subject to a higher level of risk premia than their developed counterparts, thus rewarding investors with a higher yield. Figure 3 shows the stages of development as emerging countries transition towards developed market status.

Source: BlueBay Asset Management

The size and sophistication of the investable universe of debt issued in emerging countries has increased substantially over the last 30 years. EM debt was once issued only sporadically and in US dollar denominations, but today far fewer EM governments require support from G-7 nations for their funding and are able to access the international capital markets directly. Moreover, because of strong internal growth, economic development and favourable macroeconomic factors, many EM sovereigns have also developed deeper domestic capital markets. This has, in many cases, translated into a significant shift to local currency debt issuance.

The EM debt universe comprises four primary sub-classes and accounts for nearly US$29 trillion3. This is a large heterogenous asset class with debt issued in both hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

The following compares the key characteristics of the four main sub-asset classes:

The EM hard currency sovereign sub-class is the oldest and most established going back to the Brady bond era in the early 1990s. The market has since evolved significantly, presenting a broad opportunity set for investors. Not surprisingly, it has the largest group of managers involved and is more familiar to many investors.

These bonds have a global investor base and tend to trade at a spread over US Treasuries and are therefore much more sensitive to US rates. Compared to local currency bonds, hard currency bonds also tend to have longer maturities and larger issuance sizes, making them easier to trade on the secondary market. The depth of the market and diverse set of participants, including local and foreign investors, translates into higher trade volumes and strong liquidity levels.

The hard currency EM corporate debt market is a diverse and very well-established asset class which has seen strong growth in the last decade, driven by robust investor demand, rapid long-term EM economic growth, and increasing integration into global capital markets. Despite being a majority investment grade (IG) rated asset class, EM corporate debt has offered higher yield over similarly rated DM corporates, a reflection of the higher risk premium investors typically require when investing in EM. However, investor perception of risk in emerging markets is changing as corporate governance and transparency continue to improve and macro policy across the EM universe has become more orthodox.

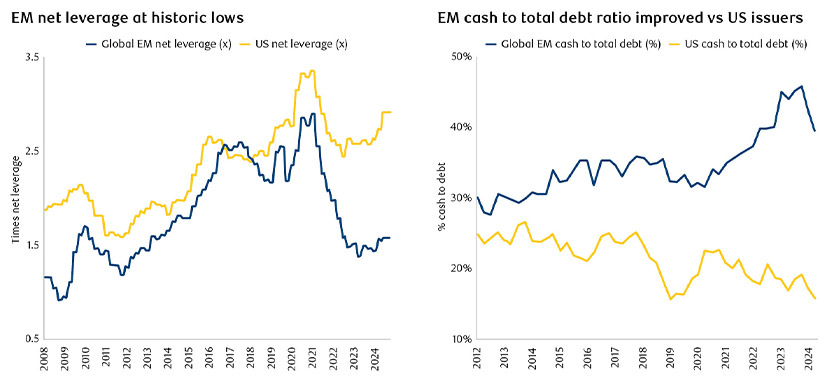

At a company level, fundamentals have seen considerable improvement over the last few years as EM corporates have consistently reported lower leverage and higher cash to total debt ratios than their US counterparts. Currently, the difference in net leverage and cash to debt ratio in EM vs DM (using US corporates as a proxy) stands above 10-year highs (Figure 4).

Source: Bank of America, Merrill Lynch, as at 31 December 2024.

The EM local currency market is a vast, rapidly growing universe. The range includes countries that are more mature, with a full scope of liquid cash and derivative instruments, to markets that are considered ‘frontier’, embarking on a long and difficult process of opening their capital accounts and deepening their local markets to attract foreign capital.

Opportunities for diversification are vast, with a multitude of sovereign and corporate issuers, inflation-linked and nominal debt, free floating to managed or pegged currencies. Debt denominated in local EM currencies typically have shorter duration and are more influenced by local inflation expectations and central bank policies. Investors in EM local currency debt tend to be domestic market participants and specialized EM funds.

Despite the breadth of the opportunity set, the most widely used index – the JPM GBI-EM Global Diversified Index Unhedged – reflects only a very specific subset of the universe, limited to the larger, more liquid markets. The price for limiting the benchmark to this subset, however, is that it has become a very concentrated and highly volatile point of reference for the market. Indeed, this detracts from the very specific diversification benefits which draw investors to this asset class in the first place.

The EM local currency corporate debt market, in its broadest form, covers over 80% of the global EM debt universe, with local capital markets in varying stages of development. This ranges from more mature EM countries, such as Brazil and Mexico, to markets that are considered frontier, such as Kazakhstan, and which can offer idiosyncratic opportunities. Local currency corporates typically offer higher yields when compared to local currency sovereigns due to the additional credit risk, and they are often less liquid with fragmented issuance across different countries and regulatory frameworks.

In addition, while governments actively seek foreign investment for local currency sovereign bonds, corporate debt tends to have greater restriction on foreign investor participation. These challenges combined have limited the level of foreign investor sponsorship of the local currency EM corporate sub-asset class, despite the overall higher credit ratings and lower duration risk.

1 JPMorgan, RBC BlueBay Asset Management, as at December 2024.

2 IMF, as at Q3 2024.

3 JPMorgan, as at 31 December 2024.

4 RBC Global Asset Management, as at 31 December 2024.

5 Quasi-sovereign: an entity that is 100% guaranteed by a sovereign or majority owned or controlled by a sovereign.

6 RBC Global Asset Management, as at 31 December 2024.

7, 8 RBC Global Asset Management, as at 31 December 2024.

Iscriviti ora per ricevere gli ultimi approfondimenti economici e sugli investimenti dei nostri esperti, inviati direttamente alla tua casella di posta elettronica.

Il presente documento costituisce una comunicazione di marketing e può essere prodotto e distribuito dai soggetti di seguito specificati. Nello Spazio Economico Europeo (SEE) il soggetto autorizzato è BlueBay Funds Management Company S.A. (BBFM S.A.), che è regolamentata dalla Commission de Surveillance du Secteur Financier (CSSF). In Germania, Italia, Spagna e Paesi Bassi, BFM S.A. opera con un passaporto di filiale ai sensi della Direttiva sugli Organismi di investimento collettivo in valori mobiliari (2009/65/CE) e della Direttiva sui Gestori di Fondi di investimento alternativo (2011/61/UE). Nel Regno Unito, la produzione e distribuzione sono curate da RBC Global Asset Management (UK) Limited (RBC GAM UK), che è autorizzata e regolamentata dall’Autorità di vigilanza finanziaria del Regno Unito (FCA), registrata presso la Securities and Exchange Commission (SEC) statunitense e membro della National Futures Association (NFA) su autorizzazione della Commodity Futures Trading Commission (CFTC) statunitense. In Svizzera, la produzione e distribuzione sono curate da BlueBay Asset Management AG il cui Rappresentante e agente per i pagamenti è BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurigo (Svizzera). Il luogo di adempimento è stabilito presso la sede legale del Rappresentante. I tribunali della sede legale del rappresentante svizzero o della sede legale o del luogo di residenza dell’investitore sono competenti per i reclami relativi all’offerta e/o alla pubblicità di azioni in Svizzera. Il Prospetto, i Documenti contenenti le informazioni chiave per gli investitori (KIID), i Documenti contenenti le informazioni chiave dei Prodotti d’investimento al dettaglio e assicurativi preassemblati (KID dei PRIIP), ove applicabili, lo Statuto e qualsiasi altro documento richiesto, come le Relazioni annuali e infrannuali, si possono ottenere gratuitamente dal Rappresentante in Svizzera. In Giappone, la produzione e distribuzione sono curate da BlueBay Asset Management International Limited, che è registrata presso il Kanto Local Finance Bureau del Ministero delle Finanze giapponese. In Asia, la produzione e distribuzione sono curate da RBC Global Asset Management (Asia) Limited, società registrata presso la Securities and Futures Commission (SFC) di Hong Kong. In Australia, RBC GAM UK è esente dall’obbligo di possedere una licenza australiana di servizi finanziari ai sensi del Corporations Act per quanto riguarda i servizi finanziari, in quanto è regolata dalla FCA secondo le leggi del Regno Unito che differiscono dalle leggi australiane. In Canada, da RBC Global Asset Management Inc. (che include PH&N Institutional), che è regolamentata dalle commissioni titoli provinciali e territoriali presso la quale è registrata. RBC GAM UK non è registrata ai sensi delle leggi sui valori mobiliari e si affida all'esenzione per i dealer internazionali prevista dalla legislazione provinciale applicabile sui valori mobiliari, che consente a RBC GAM UK di svolgere alcune attività specifiche di dealer per quei residenti canadesi che si qualificano come "cliente canadese autorizzato", in quanto tale termine è definito dalla legislazione applicabile sui valori mobiliari. Negli Stati Uniti, la produzione e distribuzione sono curate da RBC Global Asset Management (U.S.) Inc. (“RBC GAM-US”), una società di consulenza finanziaria registrata presso la SEC. Le entità di cui sopra sono collettivamente denominate “RBC BlueBay” all’interno del presente documento. Le registrazioni e adesioni effettuate non devono intendersi quale approvazione o autorizzazione di RBC BlueBay da parte delle rispettive autorità preposte al rilascio delle licenze o alla registrazione. I prodotti, i servizi o gli investimenti qui descritti possono non essere disponibili in tutte le giurisdizioni o essere disponibili solo su base limitata, a causa dei requisiti normativi e legali locali.

Il presente documento è destinato esclusivamente a “Clienti professionali” e “Controparti qualificate” (come definite dalla Direttiva sui mercati degli strumenti finanziari (“MiFID”) o dalla FCA); in Svizzera a “Investitori qualificati”, come definiti dall’Articolo 10 della Legge svizzera sugli investimenti collettivi di capitale e della relativa ordinanza attuativa; negli Stati Uniti, a “Investitori accreditati” (come definiti nel Securities Act del 1933) o ad “Acquirenti qualificati” (come definiti nell’Investment Company Act del 1940), a seconda dei casi, e non dev’essere considerato attendibile da altra categoria di clienti.

Se non diversamente specificato, tutti i dati sono stati forniti da RBC BlueBay. Per quanto a conoscenza di RBC BlueBay, il presente documento è veritiero e corretto alla data attuale. RBC BlueBay non rilascia alcuna garanzia esplicita o implicita né alcuna dichiarazione riguardo alle informazioni contenute nel presente documento e declina espressamente ogni garanzia di accuratezza, completezza o idoneità per un particolare scopo. Opinioni e stime derivano da una nostra valutazione e sono soggette a modifica senza preavviso. RBC BlueBay non fornisce consulenza in materia di investimenti né di altra natura e il presente documento non esprime alcuna consulenza né deve essere interpretato come tale. Il presente documento non costituisce un’offerta di vendita o la sollecitazione di un’offerta di acquisto di titoli o prodotti d’investimento in qualsiasi giurisdizione e ha finalità puramente informative.

È fatto divieto di riprodurre, distribuire o trasmettere, direttamente o indirettamente, ogni parte del presente documento a qualsiasi altra persona o di pubblicare, in tutto o in parte, i suoi contenuti per qualunque scopo e in qualsiasi modo senza il previo consenso scritto di RBC BlueBay. Copyright 2023 © RBC BlueBay. RBC Global Asset Management (RBC GAM) è la divisione di gestione patrimoniale di Royal Bank of Canada (RBC) che comprende RBC Global Asset Management Inc. (U.S.) Inc. (RBC GAMUS), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited e RBC Global Asset Management (Asia) Limited, società indipendenti ma affiliate di RBC. ® / Marchio/i registrato/i di Royal Bank of Canada e BlueBay Asset Management (Services) Ltd. Utilizzato su licenza. BlueBay Funds Management Company S.A., sede legale all’indirizzo 4, Boulevard Royal L-2449 Luxembourg, società registrata in Lussemburgo con il numero B88445. RBC Global Asset Management (UK) Limited, con sede legale all’indirizzo 100 Bishopsgate, London EC2N 4AA, società in nome collettivo registrata in Inghilterra e Galles con il numero 03647343. Tutti i diritti riservati.

Iscriviti ora per ricevere gli ultimi approfondimenti economici e sugli investimenti dei nostri esperti, inviati direttamente alla tua casella di posta elettronica.