Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Principaux enseignements

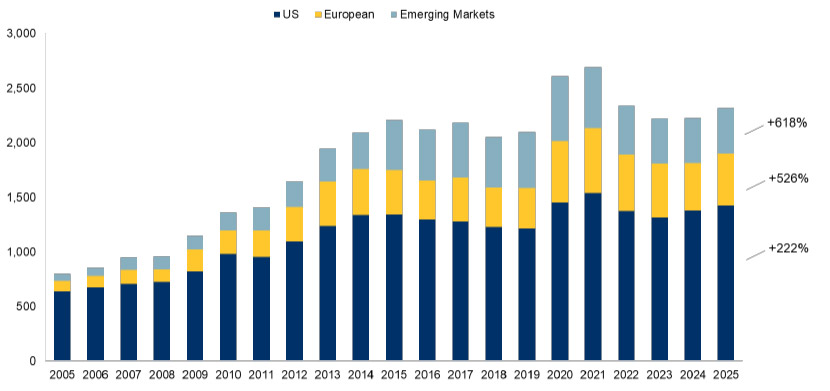

Ces derniers temps, les obligations à haut rendement ont continué de susciter un vif intérêt auprès des investisseurs, et les arguments en faveur de l’investissement dans cette classe d’actifs reposent sur plusieurs facteurs convaincants, notamment des rendements attrayants, des fondamentaux solides, des avantages de diversification et des effets favorables de la législation. En outre, le marché mondial de la dette HY a connu une croissance significative au cours des deux dernières décennies, passant de 800 milliards USD en 2005 à 2300 milliards USD aujourd’hui. Cette croissance a transformé la dette d’entreprise HY en une classe d’actifs véritablement mondiale, avec des contributions croissantes de l’Europe et des marchés émergents (EM) aux côtés des États-Unis. En combinant les ME et les MD, les investisseurs peuvent accéder à un portefeuille diversifié qui offre des opportunités intéressantes dans toutes les régions.

Historiquement, la dette HY des États-Unis a dominé le marché. Toutefois, la progression de la dette HY européenne et des ME a créé de nouvelles possibilités de diversification et d’amélioration des rendements. Cette approche globale permet d’accéder à des spreads incrémentaux sans compromettre la qualité du crédit puisque la classe d’actifs conserve une notation de crédit moyenne de BB- et une duration de 3 ans. En outre, elle favorise la diversification sectorielle, ce qui permet aux investisseurs de saisir des opportunités distinctes dans toutes les régions.

Source : ICE BofA, au 31 juillet 2025. European HY Index désigne l’indice ICE BofA European Currency HY Constrained, EM HY Index désigne l’indice ICE BofA HY EM Corporate Plus et U.S. HY Index désigne l’indice ICE BofA U.S. HY.

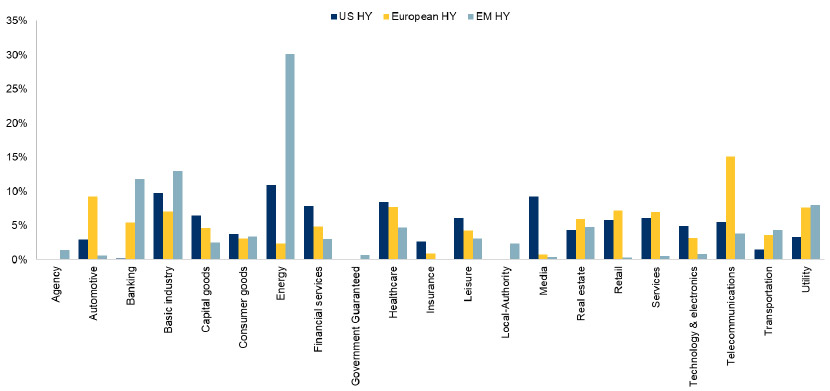

Aux États-Unis, le marché HY offre une grande visibilité au secteur des médias, qui a été un point chaud pour la consolidation de l’industrie et les fusions-acquisitions attrayantes. La dette européenne HY est fortement concentrée sur les télécommunications, un secteur défensif réputé pour ses bénéfices stables et reproductibles. Les titres HY d’entreprises des ME, quant à eux, sont orientés vers des ressources telles que l’énergie et les industries de base, ainsi que le secteur bancaire. Ces secteurs complètent leurs pairs des MD, améliorant ainsi le profil risque-rendement global du portefeuille.

Source : RBC GAM, ICE BofA, au 31 juillet 2025. European HY Index désigne l’indice ICE BofA European Currency HY Constrained, EM HY Index désigne l’indice ICE BofA HY EM Corporate Plus et U.S. HY Index désigne l’indice ICE BofA U.S. HY.

Au fil du temps, le marché HY mondial a fait preuve de résilience en période de tensions sur les marchés, telles que la crise énergétique et la pandémie de Covid-19. En ces temps difficiles, le marché a démontré sa capacité à protéger le capital tout en offrant des rendements attrayants. Même dans des conditions de marché favorables, elle a généré de solides rendements, ce qui souligne son potentiel de performance sur différents cycles de marché.

En combinant les opportunités des ME et des MD, le marché mondial HY offre une approche diversifiée et résiliente pour négocier les cycles du marché et obtenir de la valeur à long terme.

Abonnez-vous dès à présent pour recevoir directement dans votre boîte mail les dernières perspectives de nos experts sur l’économie et l’investissement.

This document is a marketing communication and it may be produced and issued by the following entities: in the European Economic Area (EEA), by BlueBay Funds Management Company S.A. (BBFM S.A.), which is regulated by the Commission de Surveillance du Secteur Financier (CSSF). In Germany, Italy, Spain and Netherlands the BBFM S.A is operating under a branch passport pursuant to the Undertakings for Collective Investment in Transferable Securities Directive (2009/65/EC) and the Alternative Investment Fund Managers Directive (2011/61/EU). In the United Kingdom (UK) by RBC Global Asset Management (UK) Limited (RBC GAM UK), which is authorised and regulated by the UK Financial Conduct Authority (FCA), registered with the US Securities and Exchange Commission (SEC) and a member of the National Futures Association (NFA) as authorised by the US Commodity Futures Trading Commission (CFTC). In Switzerland, by BlueBay Asset Management AG where the Representative and Paying Agent is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The place of performance is at the registered office of the Representative. The courts at the registered office of the Swiss representative or at the registered office or place of residence of the investor shall have jurisdiction pertaining to claims in connection with the offering and/or advertising of shares in Switzerland. The Prospectus, the Key Investor Information Documents (KIIDs), the Packaged Retail and Insurance-based Investment Products - Key Information Documents (PRIIPs KID), where applicable, the Articles of Incorporation and any other document required, such as the Annual and Semi-Annual Reports, may be obtained free of charge from the Representative in Switzerland. In Japan, by BlueBay Asset Management International Limited which is registered with the Kanto Local Finance Bureau of Ministry of Finance, Japan. In Asia, by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong. In Australia, RBC GAM UK is exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of financial services as it is regulated by the FCA under the laws of the UK which differ from Australian laws. In Canada, by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. RBC GAM UK is not registered under securities laws and is relying on the international dealer exemption under applicable provincial securities legislation, which permits RBC GAM UK to carry out certain specified dealer activities for those Canadian residents that qualify as "a Canadian permitted client”, as such term is defined under applicable securities legislation. In the United States, by RBC Global Asset Management (U.S.) Inc. ("RBC GAM-US"), an SEC registered investment adviser. The entities noted above are collectively referred to as “RBC BlueBay” within this document. The registrations and memberships noted should not be interpreted as an endorsement or approval of RBC BlueBay by the respective licensing or registering authorities. Not all products, services or investments described herein are available in all jurisdictions and some are available on a limited basis only, due to local regulatory and legal requirements.

This document is intended only for “Professional Clients” and “Eligible Counterparties” (as defined by the Markets in Financial Instruments Directive (“MiFID”) or the FCA); or in Switzerland for “Qualified Investors”, as defined in Article 10 of the Swiss Collective Investment Schemes Act and its implementing ordinance, or in the US by “Accredited Investors” (as defined in the Securities Act of 1933) or “Qualified Purchasers” (as defined in the Investment Company Act of 1940) as applicable and should not be relied upon by any other category of customer.

Unless otherwise stated, all data has been sourced by RBC BlueBay. To the best of RBC BlueBay’s knowledge and belief this document is true and accurate at the date hereof. RBC BlueBay makes no express or implied warranties or representations with respect to the information contained in this document and hereby expressly disclaim all warranties of accuracy, completeness or fitness for a particular purpose. Opinions and estimates constitute our judgment and are subject to change without notice. RBC BlueBay does not provide investment or other advice and nothing in this document constitutes any advice, nor should be interpreted as such. This document does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product in any jurisdiction and is for information purposes only.

No part of this document may be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose in any manner without the prior written permission of RBC BlueBay. Copyright 2023 © RBC BlueBay. RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated corporate entities. ® / Registered trademark(s) of Royal Bank of Canada and BlueBay Asset Management (Services) Ltd. Used under licence. BlueBay Funds Management Company S.A., registered office 4, Boulevard Royal L-2449 Luxembourg, company registered in Luxembourg number B88445. RBC Global Asset Management (UK) Limited, registered office 100 Bishopsgate, London EC2N 4AA, registered in England and Wales number 03647343. All rights reserved.

Abonnez-vous dès à présent pour recevoir directement dans votre boîte mail les dernières perspectives de nos experts sur l’économie et l’investissement.