Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the International Monetary Fund (IMF) with the remaining classified as ‘emerging market and developing’.

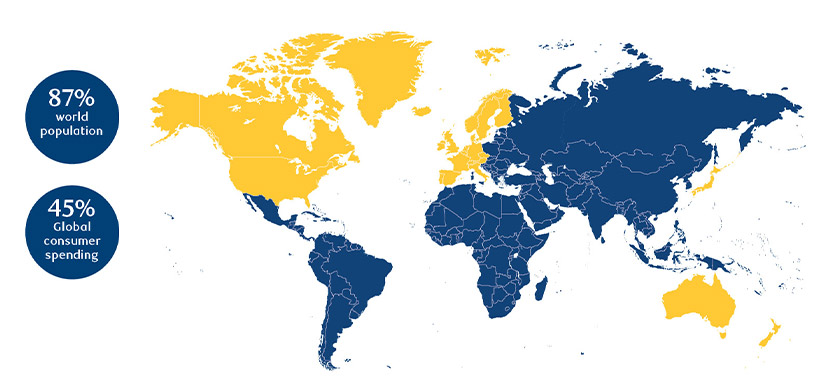

Combined, emerging market economies account for over 50% of global Gross Domestic Product (GDP), 45% of global consumer spending and roughly 87% of the world’s population2. The EM debt universe comprises four primary sub-classes: hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

Source: RBC GAM, as at December 2024.

Despite being the world’s largest pool of credit, at $29 trillion in size, EMD or emerging market debt remains one of the most misunderstood markets amongst investors, not only in terms of composition of the asset class but also the risk-reward profile of the underlying assets. Indeed, asset allocators and investors alike are often surprised to discover the breadth, versatility and return opportunities the asset class can offer their portfolios and, moreover, the fundamental and liquidity characteristics of various sub-asset classes.

In the note below, we provide an overview of EMD, summarizing the distinct sub-asset classes that offer differentiated risk-return characteristics that can potentially enhance portfolio outcomes.

Emerging market debt refers to the outstanding tradeable debt issued by emerging market governments or corporations domiciled in those countries. Although there is no official definition, within capital markets the term ‘emerging markets’ is generally used to refer to countries with lower per capita income and limited integration within the global financial system.

While they have may have an established financial infrastructure, the institutional strengths and market characteristics of these emerging markets may not be on par with the efficiency, accounting standards or securities regulations of ‘developed’ nations.

Of the roughly 200 countries in the world today, 41 are considered ‘developed’ economies by the IMF with the remaining classified as ‘emerging market and developing’. These countries are widely dispersed across Latin America, Asia, Eastern Europe, the Middle East and Africa, and range in size from giants like China and India to much smaller countries such as Belize and Ivory Coast. Combined, emerging market economies account for over 50% of global GDP, 45% of global consumer spending and roughly 87% of the world’s population.

Source: Oxford Economics and the IMF, as at 30 September 2024

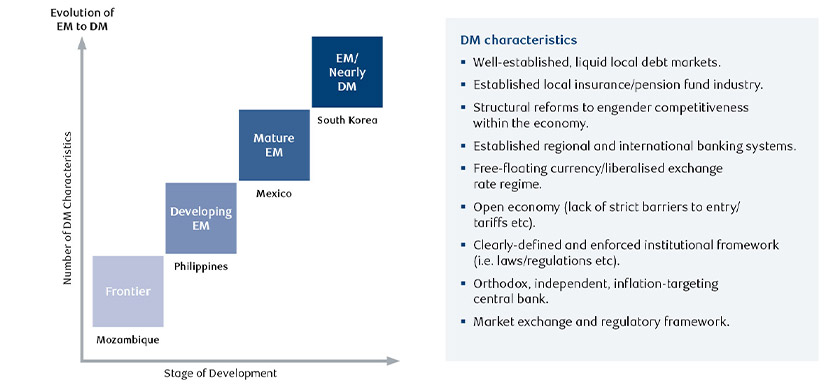

Market liquidity and governance factors have historically been a key factor in defining classification. Some countries such as South Korea are considered developed by the IMF but deemed as emerging by some market participants. Likewise, some EM countries, such as Brazil, China, and India rank amongst the world’s largest economies, but are considered by most as emerging economies. At the opposite end of the spectrum there are frontier markets (less developed economies) such as Mozambique, which are typically smaller and have less liquid capital markets.

Clearly these markets will not have progressed as far down the path as today’s developed markets (DM), and as such, debt from these economies will be subject to a higher level of risk premia than their developed counterparts, thus rewarding investors with a higher yield. Figure 3 shows the stages of development as emerging countries transition towards developed market status.

Source: BlueBay Asset Management

The size and sophistication of the investable universe of debt issued in emerging countries has increased substantially over the last 30 years. EM debt was once issued only sporadically and in US dollar denominations, but today far fewer EM governments require support from G-7 nations for their funding and are able to access the international capital markets directly. Moreover, because of strong internal growth, economic development and favourable macroeconomic factors, many EM sovereigns have also developed deeper domestic capital markets. This has, in many cases, translated into a significant shift to local currency debt issuance.

The EM debt universe comprises four primary sub-classes and accounts for nearly US$29 trillion3. This is a large heterogenous asset class with debt issued in both hard currency (denominated in a globally traded currency of a developed country, such as the US dollar or euro) and local currency and containing both sovereign and corporate debt.

The following compares the key characteristics of the four main sub-asset classes:

The EM hard currency sovereign sub-class is the oldest and most established going back to the Brady bond era in the early 1990s. The market has since evolved significantly, presenting a broad opportunity set for investors. Not surprisingly, it has the largest group of managers involved and is more familiar to many investors.

These bonds have a global investor base and tend to trade at a spread over US Treasuries and are therefore much more sensitive to US rates. Compared to local currency bonds, hard currency bonds also tend to have longer maturities and larger issuance sizes, making them easier to trade on the secondary market. The depth of the market and diverse set of participants, including local and foreign investors, translates into higher trade volumes and strong liquidity levels.

The hard currency EM corporate debt market is a diverse and very well-established asset class which has seen strong growth in the last decade, driven by robust investor demand, rapid long-term EM economic growth, and increasing integration into global capital markets. Despite being a majority investment grade (IG) rated asset class, EM corporate debt has offered higher yield over similarly rated DM corporates, a reflection of the higher risk premium investors typically require when investing in EM. However, investor perception of risk in emerging markets is changing as corporate governance and transparency continue to improve and macro policy across the EM universe has become more orthodox.

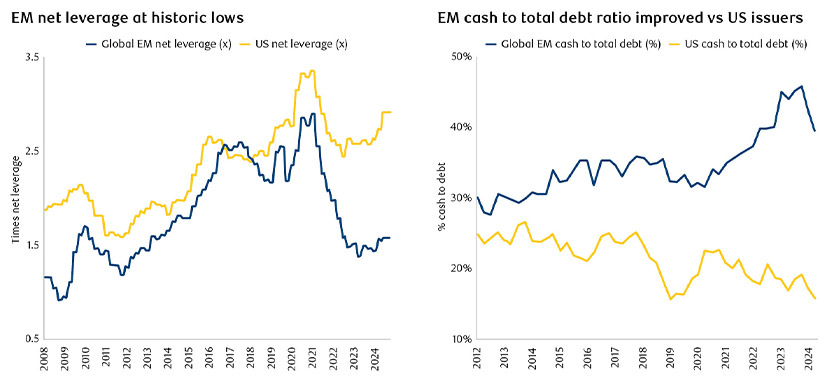

At a company level, fundamentals have seen considerable improvement over the last few years as EM corporates have consistently reported lower leverage and higher cash to total debt ratios than their US counterparts. Currently, the difference in net leverage and cash to debt ratio in EM vs DM (using US corporates as a proxy) stands above 10-year highs (Figure 4).

Source: Bank of America, Merrill Lynch, as at 31 December 2024.

The EM local currency market is a vast, rapidly growing universe. The range includes countries that are more mature, with a full scope of liquid cash and derivative instruments, to markets that are considered ‘frontier’, embarking on a long and difficult process of opening their capital accounts and deepening their local markets to attract foreign capital.

Opportunities for diversification are vast, with a multitude of sovereign and corporate issuers, inflation-linked and nominal debt, free floating to managed or pegged currencies. Debt denominated in local EM currencies typically have shorter duration and are more influenced by local inflation expectations and central bank policies. Investors in EM local currency debt tend to be domestic market participants and specialized EM funds.

Despite the breadth of the opportunity set, the most widely used index – the JPM GBI-EM Global Diversified Index Unhedged – reflects only a very specific subset of the universe, limited to the larger, more liquid markets. The price for limiting the benchmark to this subset, however, is that it has become a very concentrated and highly volatile point of reference for the market. Indeed, this detracts from the very specific diversification benefits which draw investors to this asset class in the first place.

The EM local currency corporate debt market, in its broadest form, covers over 80% of the global EM debt universe, with local capital markets in varying stages of development. This ranges from more mature EM countries, such as Brazil and Mexico, to markets that are considered frontier, such as Kazakhstan, and which can offer idiosyncratic opportunities. Local currency corporates typically offer higher yields when compared to local currency sovereigns due to the additional credit risk, and they are often less liquid with fragmented issuance across different countries and regulatory frameworks.

In addition, while governments actively seek foreign investment for local currency sovereign bonds, corporate debt tends to have greater restriction on foreign investor participation. These challenges combined have limited the level of foreign investor sponsorship of the local currency EM corporate sub-asset class, despite the overall higher credit ratings and lower duration risk.

1 JPMorgan, RBC BlueBay Asset Management, as at December 2024.

2 IMF, as at Q3 2024.

3 JPMorgan, as at 31 December 2024.

4 RBC Global Asset Management, as at 31 December 2024.

5 Quasi-sovereign: an entity that is 100% guaranteed by a sovereign or majority owned or controlled by a sovereign.

6 RBC Global Asset Management, as at 31 December 2024.

7, 8 RBC Global Asset Management, as at 31 December 2024.

Erhalten Sie jetzt aktuelle Investment- und Wirtschaftsanalysen unserer Experten direkt in Ihre Mailbox.

Bei diesem Dokument handelt es sich um eine Marketingmitteilung, die von folgenden Stellen erstellt und herausgegeben werden kann: im Europäischen Wirtschaftsraum (EWR) von BlueBay Funds Management Company S.A. (BBFM S.A.), die von der Commission de Surveillance du Secteur Financier (CSSF) reguliert wird. In Deutschland, Italien, Spanien und den Niederlanden ist die BBFM S.A. im Rahmen einer Zweigniederlassungsgenehmigung gemäss der Richtlinie über Organismen für gemeinsame Anlagen in Wertpapieren (2009/65/EG) und der Richtlinie über die Verwalter alternativer Investmentfonds (2011/61/EU) tätig. Im Vereinigten Königreich (UK) durch RBC Global Asset Management (UK) Limited (RBC GAM UK), die von der britischen Financial Conduct Authority (FCA) zugelassen und beaufsichtigt wird, bei der US Securities and Exchange Commission (SEC) registriert ist und Mitglied der National Futures Association (NFA) ist, die von der US Commodity Futures Trading Commission (CFTC) zugelassen ist. In der Schweiz durch die BlueBay Asset Management AG, deren Vertreter und Zahlstelle die BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zürich, Schweiz ist. Der Erfüllungsort befindet sich am Sitz des Vertreters. Für Klagen im Zusammenhang mit dem Angebot und/oder der Bewerbung von Aktien in der Schweiz sind die Gerichte am Sitz des schweizerischen Vertreters oder am Sitz oder Wohnsitz des Anlegers zuständig. Der Prospekt, die wesentlichen Anlegerinformationen (Key Investor Information Documents - KIIDs), die wesentlichen Informationen über Anlageprodukte für Kleinanleger und Versicherungsprodukte (Packaged Retail and Insurance-based Investment Products - Key Information Documents - PRIIPs KIDs), soweit zutreffend, die Satzung und alle anderen erforderlichen Dokumente, wie z.B. die Jahres- und Halbjahresberichte, können kostenlos beim Vertreter in der Schweiz bezogen werden. In Japan durch BlueBay Asset Management International Limited, die beim Kanto Local Finance Bureau des japanischen Finanzministeriums registriert ist. In Asien durch RBC Global Asset Management (Asia) Limited, die bei der Securities and Futures Commission (SFC) in Hongkong registriert ist. In Australien ist RBC GAM UK von dem Erfordernis einer australischen Finanzdienstleistungslizenz gemäss dem Corporations Act befreit, da sie von der FCA nach den Gesetzen des Vereinigten Königreichs reguliert wird, die sich von den australischen Gesetzen unterscheiden. In Kanada durch RBC Global Asset Management Inc. (einschließlich PH&N Institutional), die der Aufsicht der Wertpapieraufsichtsbehörde der jeweiligen Provinz bzw. des Territoriums unterliegt, bei der sie registriert ist. RBC GAM UK ist nicht nach den Wertpapiergesetzen registriert und beruft sich auf die Ausnahmeregelung für internationale Händler nach den geltenden Wertpapiergesetzen der Provinzen, die es RBC GAM UK erlaubt, bestimmte spezifizierte Händlertätigkeiten für in Kanada ansässige Personen auszuüben, die als "zugelassener kanadischer Kunde" im Sinne der geltenden Wertpapiergesetze gelten. In den Vereinigten Staaten durch RBC Global Asset Management (U.S.) Inc. („RBC GAM-US“), einen bei der SEC registrierten Anlageberater. Die oben genannten Unternehmen werden in diesem Dokument gemeinsam als „RBC BlueBay“ bezeichnet. Die angegebenen Registrierungen und Mitgliedschaften sind nicht als Befürwortung oder Genehmigung von RBC BlueBay durch die jeweiligen lizenzierenden oder registrierenden Behörden auszulegen. Nicht alle hierin beschriebenen Produkte, Dienstleistungen oder Anlagen sind in allen Rechtsordnungen verfügbar, und einige sind aufgrund lokaler aufsichtsrechtlicher und rechtlicher Anforderungen nur eingeschränkt verfügbar.

Dieses Dokument ist nur für „Professionelle Kunden“ und „Geeignete Gegenparteien“ (im Sinne der Richtlinie über Märkte für Finanzinstrumente („MiFID“) oder der FCA) oder in der Schweiz für „Qualifizierte Anleger“ im Sinne von Artikel 10 des Schweizerischen Kollektivanlagengesetzes und seiner Ausführungsverordnung oder in den USA für „Zugelassene Anleger“ (im Sinne des Securities Act von 1933) oder „Qualifizierte Käufer“ (im Sinne des Investment Company Act von 1940) bestimmt und sollte von keiner anderen Kundenkategorie als verlässlich angesehen werden.

Sofern nicht anders angegeben, wurden alle Daten von RBC BlueBay bezogen. Dieses Dokument ist nach bestem Wissen und Gewissen von RBC BlueBay zum Zeitpunkt der Erstellung wahr und korrekt. RBC BlueBay gibt keine ausdrücklichen oder stillschweigenden Garantien oder Zusicherungen in Bezug auf die in diesem Dokument enthaltenen Informationen und lehnt hiermit ausdrücklich alle Garantien in Bezug auf Genauigkeit, Vollständigkeit oder Eignung für einen bestimmten Zweck ab. Meinungen und Schätzungen stellen unser Urteil dar und können ohne vorherige Ankündigung geändert werden. RBC BlueBay bietet keine Anlage- oder sonstige Beratung an, und nichts in diesem Dokument stellt eine Beratung dar und sollte auch nicht als solche interpretiert werden. Dieses Dokument stellt weder ein Angebot zum Verkauf noch eine Aufforderung zum Kauf von Wertpapieren oder Anlageprodukten in irgendeiner Rechtsordnung dar und dient ausschliesslich Informationszwecken.

Kein Teil dieses Dokuments darf zu irgendeinem Zweck oder auf irgendeine Art ohne die vorherige, schriftliche Einwilligung von RBC BlueBay reproduziert, weiterverteilt, direkt oder indirekt an irgendeine andere Person übermittelt bzw. ganz oder auszugsweise veröffentlicht werden. Copyright 2023 © RBC BlueBay. RBC Global Asset Management (RBC GAM) ist die Vermögensverwaltungsdivision der Royal Bank of Canada (RBC), zu der die RBC Global Asset Management (U.S.) Inc. (RBC GAM-US), RBC Global Asset Management Inc., RBC Global Asset Management (UK) Limited und RBC Global Asset Management (Asia) Limited gehören, bei denen es sich um separate, aber verbundene Unternehmen handelt. ® / Eingetragene Marke(n) der Royal Bank of Canada und BlueBay Asset Management (Services) Ltd. Verwendet unter Lizenz. BlueBay Funds Management Company S.A., eingetragener Sitz 4, Boulevard Royal L-2449 Luxemburg, in Luxemburg unter der Nummer B88445 eingetragene Gesellschaft. RBC Global Asset Management (UK) Limited, eingetragener Firmensitz 100 Bishopsgate, London EC2N 4AA, eingetragen in England und Wales unter der Nummer 03647343. Alle Rechte vorbehalten

Erhalten Sie jetzt aktuelle Investment- und Wirtschaftsanalysen unserer Experten direkt in Ihre Mailbox.