Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways

Exasperated by how bond markets were reining in the Clinton administration’s US economic agenda in 1993, political strategist James Carville remarked “I used to think that if there was reincarnation, I wanted to come back as the president or the pope. But now I want to come back as the bond market – you can intimidate everybody.” More than 30 years later, it continues to feel apt.

Today, it’s not just fiscal orthodoxy that markets are baulking at – it’s stability itself. Tariffs, shifting rhetoric, and political unpredictability are generating the kind of policy-driven volatility that’s difficult to model and harder still to ignore. Ironically, the US administration’s approach looks less like “Make America Great Again” and more like “Make Volatility Great Again.”

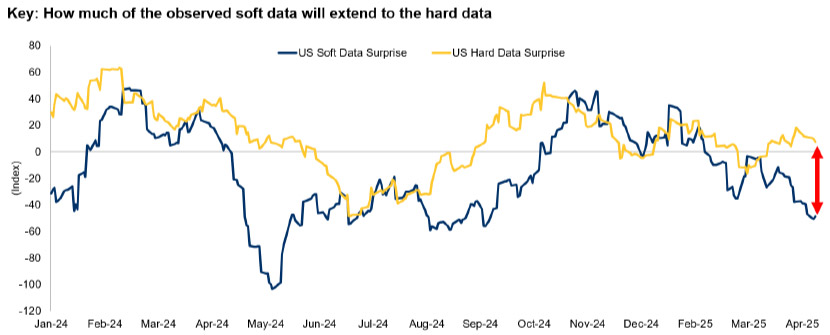

The effects are already visible. Soft data has started to weaken and, although hard data has thus far held up, history suggests this kind of divergence rarely lasts. Either expectations rebound, or activity slows.

Tariffs are causing uncertainty and falling confidence in the US

Source: Citigroup, as at April 2025.

Volatility has picked up, but the fundamentals for investment grade credit remain sound. Default rates are low, balance sheets are generally healthy, and in selective parts of the market, yields offer more than reasonable compensation for the risks involved. Global growth is likely to slow, but our base case is that we avoid recession. While not without risks, this scenario remains broadly supportive for the asset class.

While the policy backdrop remains noisy – particularly around tariffs – the US administration has clearly softened its stance since the initial “Liberation Day” announcements. Market reactions have likely encouraged the shift to a more pragmatic stance, suggesting that, like in 1993, investors are collectively helping to define the boundaries of what is politically and economically viable. The disappointing reception to the US Treasury auction earlier this month represents another reminder that there are limits to what the market will tolerate.

In our view, this is not a time to stand back. It’s a time to be selective.

Volatility in 2025 isn’t indiscriminate. It’s creating meaningful divergence between sectors, with policy uncertainty acting as a key driver. Credit spreads are adjusting in different directions depending on how exposed companies are to global trade, how reliant they are on complex supply chains, and how sensitive they are to shifts in economic momentum.

Take European autos and industrials. These sectors are being hit by a combination of weaker sentiment, softer demand and growing concerns around export disruption. As large-scale producers often reliant on complex supply chains, they are particularly exposed to tariffs and rising input costs. That pressure is visible in the data, where confidence indicators have turned lower, and in market pricing, with spreads widening.

By contrast, areas like aerospace and defence are benefiting from the prospect of increased government spending and the emergence of a new, potentially long-term, trend towards rearmament, particularly in Europe. These sectors have strong order books and supportive policy momentum. Banks, too, continue to offer resilience. Capital buffers remain robust, profitability has improved, and non-performing loans are near record lows. In short, the fundamentals for financial credit look stronger than for many years.

This kind of dispersion isn’t new, but it is to be welcomed by active credit investors like ourselves, because it provides a broader set of opportunities to generate returns through selective positioning, rather than relying on broad market direction.

Volatility is likely to remain a defining feature of markets in the months ahead – not just because of what’s happening in the real economy, but because of the policy uncertainty surrounding it. At the same time, dispersion is widening. Pricing across sectors, capital structures and regions is increasingly differentiated.

For active credit investors, that creates opportunity. It’s the kind of environment that plays to the strengths of a flexible, selective approach. We’ve positioned our strategies accordingly – adding exposure where the backdrop looks supportive and avoiding the areas most vulnerable to the pressures now unfolding.