Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways

When we think about leveraged finance today, we believe that it is offering very interesting return potential. Currently, yields are such that we expect a high single-digit type of return for the asset class, in dollar terms. That comes from a combination of strong carry, which is a combination of base rates and spreads, but also alpha opportunities and total return opportunities from the dispersion in sectors and single names within sectors.

The combination of higher rate spreads and total return potential is compelling and can lead to very attractive returns on a go-forward basis. While we view the underlying fundamentals as strong, it’s important to highlight that the technical picture continues to be supportive. There are a few factors driving this:

1) Overall corporate M&A volumes have been quite low for a couple of years. The expectation this year was that they would pick up, but due to macro uncertainty, they are still at the lower end. We don’t expect a significant amount of new supply (in terms of new M&A) to come to the market that will lead to HY issuance. This is a positive technical for the market.

2) We are seeing inflows continue to pick up. This signals that investors remain attracted to the broader strength of the credit profile for the asset class. There is a focus on taking HY credit exposure, especially when rates and spreads are as attractive as they are currently. On top of that, there is a strong return of cash coming back to the asset class from coupons payments. These coupons have gravitated higher, and investors are re-investing these strong coupon payments.

The asset class has continued to improve meaningfully in this regard. One positive component is that household balance sheets are in good shape, globally. Employment levels are stable, and while consumers have been impacted by higher energy costs and the cost of living, their balance sheets are in a good place.

On the monetary side, the ECB has been on a cutting trajectory now for several quarters, while the Fed has been on hold. We expect a couple of further cuts to come for the rest of the year in Europe, but we think the key message from the monetary side is that the ECB is focused on growth.

We continue to expect 2025 defaults in US HY to be sub 2%. European HY default rates will likely rise to 5-6% when including distressed exchanges and 1.5% excluding them. In addition, overall leverage levels continue to be stable and reasonable, particularly for European corporates, although there is dispersion between sectors and between individual issuers.

In addition, over time, the rating mix has improved. Finally, there is a quality improvement that’s taking place for the asset class, in part due to lower quality credits moving to the private credit market.

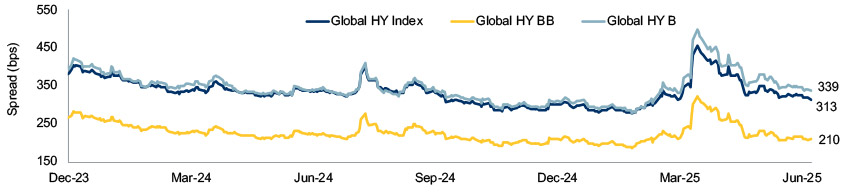

The chart below shows variability of spread levels around the Liberation Day tariff announcements. Our base expectations are for spreads to slowly grind tighter by year end. We can envisage a scenario where large BB rated fallen angels like Warner Brothers, and possibly Ford, enter HY indices while investor flows remain positive, due to the reduced risk of an imminent recession in the US and the lack of a compelling reason to meaningfully extend duration.

Source: ICE BofA, Bloomberg, 30 June 2025. Note: ICE BofA Global High Yield Constrained Index, ICE BofA BB Global High Yield Index and ICE BofA Single B Global High Yield Index

There is strong portfolio carry, yield, and total return available, and it comes with strong technical and fundamental support.

We think while the market environment is challenging, it is also very interesting from a credit picking perspective.

The alpha potential for single names will likely be more meaningful in the next 12 months, as the market continues to differentiate issuers based on company results and access to financing.