Location

Please select your investor type by clicking on a box:

We are unable to market if your country is not listed.

You may only access the public pages of our website.

Key takeaways

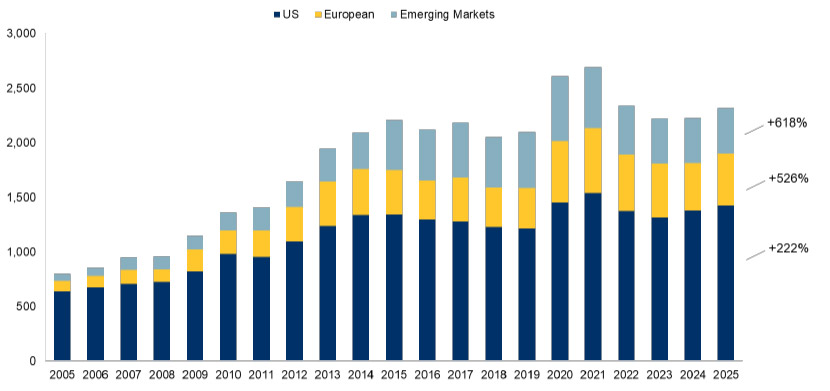

High yield (HY) bonds have continued to garner significant investor interest of late, and the case for investing in the asset class is built on several compelling factors, including attractive yields, strong fundamentals, diversification benefits, and favourable legislative tailwinds. In addition, the global HY debt market has grown significantly over the past two decades, expanding from USD0.8 trillion in 2005 to USD2.3 trillion today. This growth has transformed HY corporate debt into a truly global asset class, with increasing contributions from Europe and emerging markets (EM) alongside the U.S.. By blending EM and developed markets (DM), investors can access a diversified portfolio that offers compelling opportunities across regions.

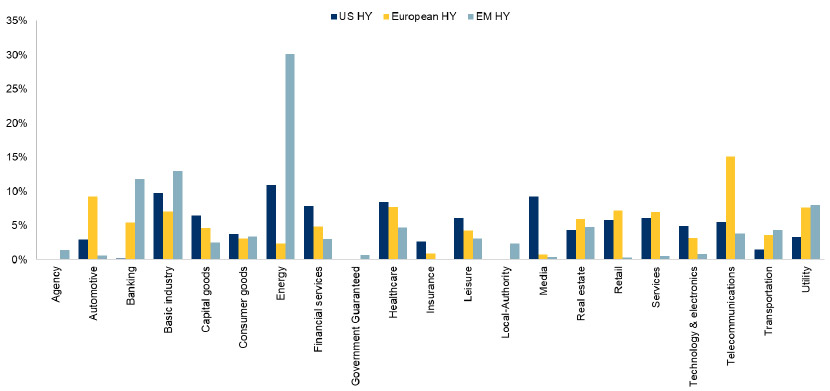

Historically, U.S. HY debt dominated the market. However, the rise of European and EM HY debt has created new opportunities for diversification and enhanced returns. This global approach provides access to incremental spreads without compromising credit quality as the asset class maintains an average BB- credit rating and a 3-year duration. Additionally, it enhances sector diversification, enabling investors to capture distinct opportunities across regions.

Source: ICE BofA, as at 31 July 2025. European HY Index refers to the ICE BofA European Currency HY Constrained Index, EM HY Index refers to the ICE BofA HY EM Corporate Plus Index and U.S. HY Index refers to the ICE BofA U.S. HY Index.

The U.S. HY market offers significant exposure to the media sector, which has been a hotspot for industry consolidation and attractive M&A. European HY debt is heavily weighted toward telecommunications, a defensive sector known for stable and repeatable earnings. EM HY corporates, on the other hand, are tilted toward resources such as energy and basic industries, as well as banking. These sectors complement DM peers, enhancing the portfolio’s overall risk-return profile.

Source: RBC GAM, ICE BofA, as at 31 July 2025. European HY Index refers to the ICE BofA European Currency HY Constrained Index, EM HY Index refers to the ICE BofA HY EM Corporate Plus Index and U.S. HY Index refers to the ICE BofA U.S. HY Index.

Over time, the global HY market has demonstrated resilience during periods of market stress, such as the energy crisis and the Covid-19 pandemic. During these challenging times, the market has shown an ability to protect principal while delivering attractive yields. Even in positive market environments, it has provided strong returns, underscoring its potential to perform well across various market cycles.

By blending EM and DM opportunities, the global HY market offers a diversified and resilient approach to navigating market cycles and achieving long-term value.